In the early 1990’s, credit-based insurance scoring caused a revolution in the insurance industry, as insurance companies used certain elements of a person’s credit history along with many other factors, to predict how likely that consumer was to have an insurance loss. Research showed that there was a high correlation.

Companies that adopted this capability in their rating plans were able to gain competitive advantage, while those that did not, suffered through adverse selection and either went through consolidation or went out of business. Today, 95% of auto insurers use in it in states where it’s a legally allowed underwriting or risk classification factor.

Growth forecast

The insurance telematics market is forecast to grow at a 50% compound annual growth rate (CAGR) by 2020, and the usage-based insurance (UBI) market is now estimated at 12 million drivers globally, according to Ptolemus Consulting Group (PCG). Simultaneously, consumers are falling in love with connected cars — adoption is growing at a rate 10 times as fast as the overall car market, and estimates forecast that 75% of cars shipped globally will be built with connected capabilities by 2020.

With actual driving data now available, telematics is strongly influencing the predictability of whether a consumer will have an insurance loss or not, and is now an important factor in the determination of insurance premium pricing. When compared to traditional rating variables, telematics data provides insurers with context about how a person drives and presents insurers with the opportunity to rate risk more accurately.

In the U.S., most of the top 10 auto insurance carriers have successfully implemented telematics-driven UBI programs. There are 45 states that have approved 10 or more such UBI programs and millions of consumers have participated in these programs. Companies that don’t adopt this capability soon will be at a disadvantage and could have a hard time being competitive in the future.

Here are five reasons insurance companies should adopt telematics and connected car programs like UBI:

1. Improved crash and claims processes – If an accident occurs while telematics data is being gathered, it can be leveraged to initiate emergency response to aid the consumer and facilitate the quick and appropriate resolution of the claim. For example, Octo’s platform and IT architecture can gather detailed information about crashes and provide insurers with user-friendly data output that includes crash details and damage evaluation tools to support the claim management process and reduce fraud.

Telematics insurance policies, on average, result in 50% fewer claims versus non-telematics policies and helps to prevent fraudulent claims, according to PCG Data. Use of telematics in Crash and Claims provides a crucially important amount of data for the adjuster to process the claim. First Notice of Loss (FNOL) data is immediately sent to insurance companies, allowing them to process the claim more efficiently for the consumer, as well as immediately send a rental car while towing away the damaged vehicle.

Overall, consumers will experience less headache and improved customer service from insurance companies in the event of a crash, as they act as a true a partner instead of a commodity provider. Touching base at the first moment of crash can also help avoid fraud attempts and third party interferences.

From an insurer’s perspective, the benefits associated are clear and tangible: assurance that a real crash actually took place, preliminary damage evaluation, lower risk of fraud, faster time to repair. The insured also benefits through real time road assistance, repair assistance and faster claims processing to get them back on the road in a safe and reliable vehicle.

Telematics allows insurance companies to turn data into customer insight and action, and can also help drivers improve driving performance, enhance their fuel economy and encourage safe driving awareness. (Photo: iStock)

2. Enhanced customer service and improved loyalty – Telematics connectivity allows for the engagement of insurance consumers with value propositions beyond the insurance paradigm (e.g. loyalty programs, vehicle diagnostics, location based services), strengthening customer satisfaction and retention. For the first time since possibly its inception, insurance is being disrupted by technology. Yet data alone won’t innovate insurance.

Insurers must apply knowledge that will drive their businesses forward and enable them to adapt to a revolutionized industry with new offerings and additional touch points. Telematics data is enabling insurers to add and broaden offerings through usage-based insurance, actuarial pricing, claim management, crash reconstruction and stolen vehicle recovery, all of which offer consumers additional reasons to interact with their insurance companies.

3. Increased profitability/loss ratio reduction – Telematics solutions should provide useful context and information relevant to the business of insurance, providing insurers with ways to reduce loss ratio, increase revenue, and improve retention. (At Octo, we’ve seen profitability rise nearly 30% for some customers, for example, and in Europe we have compared telematics users vs. non-telematics users and the loss ratio of a telematics user improves an average of 30% .) In turn, the right solutions align with insurance value proposition, enabling insurer to deliver on a promise made at policy inception.

Telematics allows insurance companies to turn data into customer insight and action, and can also help drivers improve driving performance, enhance their fuel economy and encourage safe driving awareness. Safer drivers means less claims and improved loss ratios.

4. More accurately assess and price risk – Telematics data enables insurers to better understand users: to move from viewing them as a file number to having a far deeper understanding of their driving behavior and usage, and price accordingly. With actual driving data strongly influencing the predictability of whether a consumer will have an insurance loss or not, telematics is now an important factor in the determination of insurance premium pricing. When compared to traditional rating variables, telematics data provides insurers with context about how a person drives and presents insurers with the opportunity to rate risk more accurately.

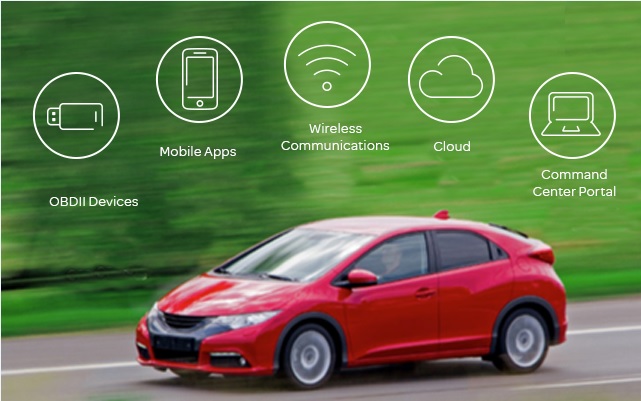

5. Vehicle diagnostics and service – Fuel efficiency, maintenance needs, tire and brake health, fluid alerts and more are taken to a new level with telematics. Connected cars can alert drivers to regular maintenance needs and tie into a services plan with preferred dealers, creating an appointment with just one touch of a screen.

Dealers can carry out remote diagnostics through the vehicle in advance of a visit, decreasing customer wait time in house, and increasing the efficiency of service. The advantage to an insurer is that drivers are operating safer vehicles that last longer — contributing to road safety, customer retention and revenue opportunities. Insurance companies can begin to tie in incentives with vehicle maintenance plans, for example.

UBI program considerations

In most cases, connecting cars via telematics and UBI are new programs for insurance companies. Telematics isn’t a simple proposition to adopt. While insurers of any size can do so with the right technology partner, there are several considerations to understand before undertaking the commitment to a UBI program.

Any telematics provider will deliver technology, but make sure they also provide superior service: management of data, training on how to use it, and explanation and training for your staff on what you need and don’t need in the program. A history and understanding of the insurance market is also a key benefit.

The connected life is upon us and insurers have an unprecedented opportunity to take advantage of it as cars become much more than just something to drive. Vehicles will soon connect to other areas of our lives related to insurance, such as the home. The Internet of Things means consumers will use their cars as a major hub for managing the emerging connected life. Insurance companies should start with telematics now and ensure they have the wherewithal and knowledge to expand as consumers also begin to embrace a fully connected lifestyle.

Read more at http://www.propertycasualty360.com/2016/07/15/5-reasons-to-embrace-telematics-for-the-connected?page_all=1