Commercial Auto is a highly troubled line of business for property & casualty insurers, suffering from historically poor performance, especially in trucking. This deters many insurers from writing certain business in the line entirely, eliminating a potential revenue stream, and plaguing those who are trying to create a profitable commercial auto portfolio.

Thomas F. Motamed, retiring chairman and CEO of CNA Financial, recently referred to the entire line as a “black eye” for the industry in the company’s third-quarter earnings call, citing an increase in distracted driving that leads to more highway accidents and deaths. Similarly, Fitch reported earlier this year that Commercial Auto is a “chronically underperforming product segment” due to overly aggressive pricing and heightened claim severity.

Playing the competitive rate game with a broad stroke approach to the market won’t help insurers achieve profitability in this line, but neither will avoiding writing business altogether. Insurers are keen to get their hands on driver and telematics data, but that is fraught with problems such as high driver turnover and the unwillingness of businesses and service providers to hand over telematics information.

Insurers are on the right track by recognizing that an increased visibility into the risks posed in each policy is key. Some commercial lines, such as workers’ compensation, have achieved incredible loss ratio improvements using analytical approaches. However, commercial auto is still in its infancy with leveraging these technologies to bolster results. There often persists a cultural resistance to using data and advanced analytics, while still maintaining a distinct competitive edge. Some believe the soft market dynamics and overall conditions are to blame, and there’s nothing that can be done. But, a growing number of insurers know they are not beholden to the market environment.

Policy ‘winners and losers’ in every vehicle class

Although increases in both loss frequency and severity have sent some insurers ‘running for the hills’ when it comes to certain vehicle segments, this creates an environment for data-driven insurers to move in and consume valuable market share that their competitors are avoiding. In fact, this idea isn’t a new concept for insurance and was first used in the 1990s by Progressive to gain considerable market share in Personal Auto. The company targeted the sub-standard market using advanced analytics to appropriately price high-risk business at adequate rates. When they had achieved success in building a portfolio around the policies that no traditional companies would touch, Progressive went mainstream to achieve the market dominant position they maintain today.

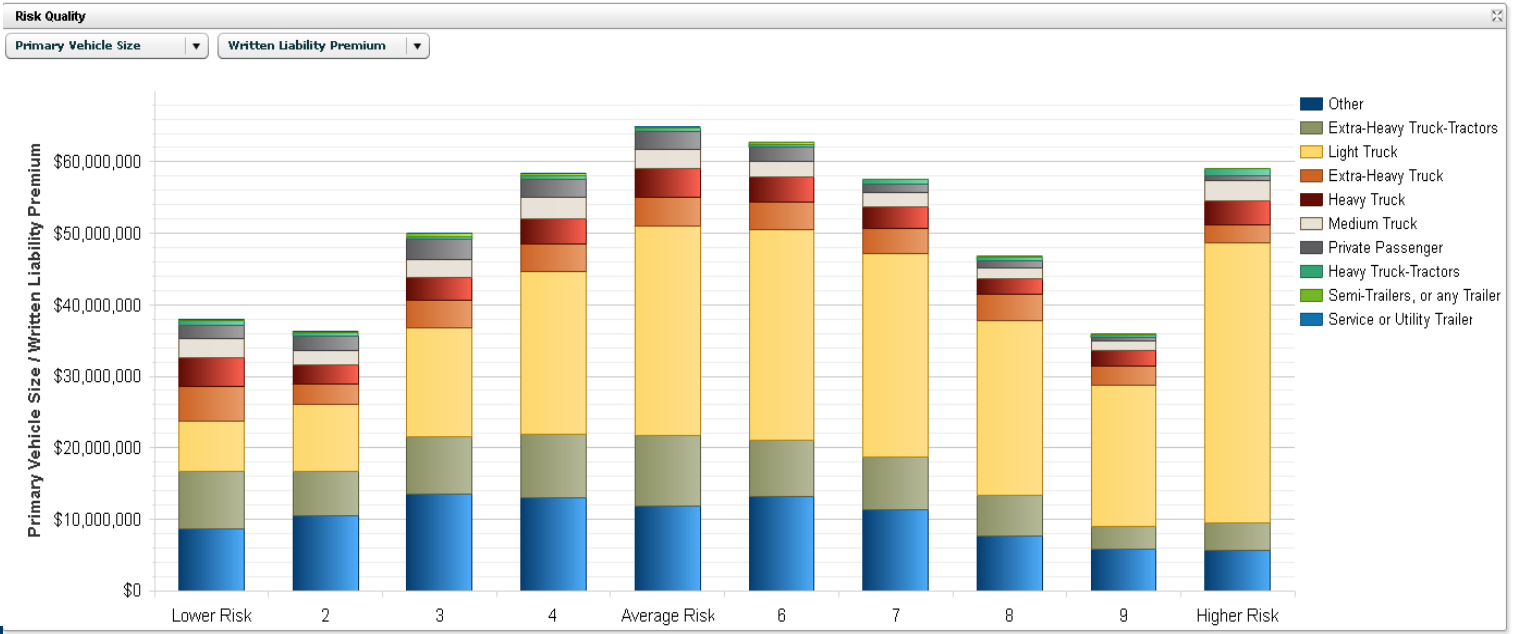

With a more accurate view into each policy, it becomes clear there are winning and losing policies, not broad-based winning and losing vehicle types. Figure 1 shows an analysis of portfolios from a handful of insurers, and indicates pockets of good risk in each vehicle class — and debunks the “magic bullet” theory of eliminating an entire vehicle class to improve loss ratio. A much more granular, policy-level assessment is needed to improve underwriting profit by making better risk selection decisions.

Figure 1. Primary vehicle size and written liability premium

Source: Valen Analytics

Achieving that granular view is what provides insurers the confidence to accept or walk away from a policy or price point, grow their business, and drastically improve their overall and by-segment loss ratio. Additionally, it allows insurers to adversely select competitors that are data-deficient. Insurers that are not employing these strategies may find themselves on the receiving end of adverse selection in an increasingly competitive marketplace.

Figure 2. Comparing predictive power decision-making in P&C underwriting

Figure 2. Comparing predictive power decision-making in P&C underwritingSource: Valen Analytics 2016 Study

Ensuring smooth implementation

It’s one thing to understand that analytics are needed in business, whether it be commercial auto or another line of insurance, and another to actually jump in and get started. History has shown that incorporating analytics helps companies improve the bottom line, but history alone has often proven to be a mediocre guide. It isn’t enough to help executives at the C-level understand and trust analytics initiatives. If insurers hope to become a data-driven company, business goals must merge with IT goals, and important steps must be taken to achieve this successfully. Project effectiveness must be measured regularly during implementation of an analytics project to build trust and gain C-level buy-in.

The first step is to set strategy and goals. Is the insurer’s goal to improve loss ratio, grow market share or reduce claim severity and frequency? Whatever is selected, the goal must be agreed upon and appropriate metrics assigned to measure the project’s effectiveness. Insurers can’t afford to take a black box approach to analytics, because without a certain degree of transparency, these initiatives can’t succeed in the skeptical insurance environment.

The second step is to ensure that suitable accommodations are made within a company to align internal communication across the entire team — from the C-suite to the front-line employees who will be using the analytics platform every day. It’s important for everyone involved to be aligned with the project and its goals, designating one person or a team to address any questions about what it will change and their specific role in adapting to the change. In underwriting analytics, this is particularly important because if underwriters don’t use a predictive model appropriately, it could undermine the success of the project — especially without a solid implementation plan and excellent data quality.

Need the ‘human touch’

One of the most important aspects of a smooth implementation and success with an analytics project is to avoid letting the technology do all the work. Predictive models should guide and streamline, not maintain full control. Valen has conducted research showing that combining analytics insights with human touch creates the best results for underwriting, regardless of business line. The combination of humans and technology creates a 185 percent improvement in lift, a metric that shows the effectiveness of pricing and risk selection decisions.

Being plagued by uncertainty is an unacceptable state for any commercial auto insurer in today’s analytically-driven world. Remove the uncertainty by knowing what you insure, allowing a much more proactive approach to the commercial auto market.

Read more at http://www.propertycasualty360.com/2016/12/21/data-analytics-key-to-solving-the-puzzle-of-commer?page_all=1