Using telematics to improve driver performance in the construction industry

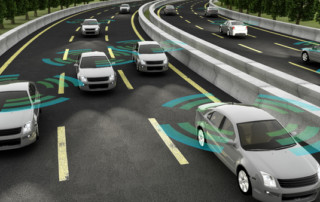

As the economy continues to recover, an increase in the frequency and severity of commercial vehicle crashes has prevented construction and other companies from fully profiting from the...