Market-based Reform of Car Insurance Rates Will Bring Unprecedented Opportunities

The “Global and China UBI Industry Report, 2017-2021” report has been added to Research and Markets’ offering.

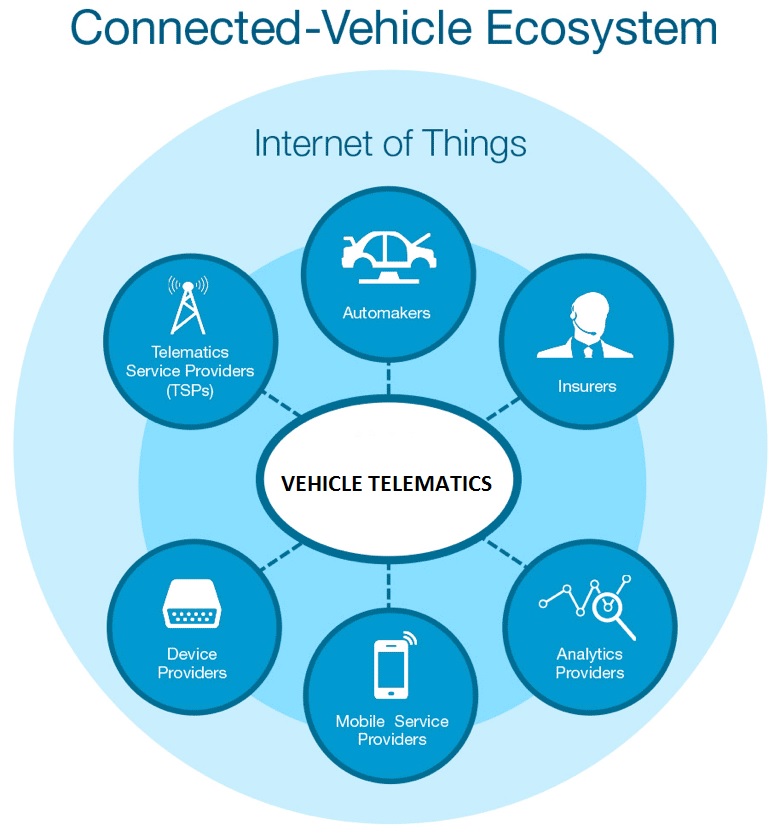

Starting in China in 2012, later than in foreign countries, UBI is primarily developed by mainly referring to foreign products and mature models. Auto insurance, always the largest subsector of property insurance in China, reported original premium income of RMB683.455 billion in 2016, up 10.3% from a year earlier and accounting for 78% of property-insurance original premium income. The reform of commercial car insurance rate management system was piloted from May 2015 and the market-oriented reform of car insurance rate was staged nationwide on July 1, 2016. Also, the rapid evolution of automotive IoT (Internet of Things) gives great impetus to the automotive UBI industry. The Chinese automotive UBI market is expected to value RMB201.8 billion in 2021 at a CAGR of 43.0%.

China’s UBI models are led by the “entities + insurers” one. Entities include OEMs, connected car firms, independent service providers, and big data companies.

1. OEMs + Insurers: OEMs usually cooperate with third parties and insurers in UBI field, represented by SAIC Motor + Cihon + CPIC. SAIC Motor and CPIC give a personalized quote for car insurance on auto models carrying OnStar according to consumers’ driving habits, mileage, and other factors. Cihon is responsible for data analysis and insurance model development.

2. Connected Car Platforms + Insurers: Connected car platforms are dominated by Aftermarket TSP (telematics service provider) in UBI field. For example, the insurer (PICC), via Shenzhen Autonet’s connected car platform, provides car owners with one-key insurance claim, quick settlement of claim, and inquiry of insurance status, and develops floating car insurance business.

3. Independent Service Providers + Insurers: Independent service providers usually acquire customer data via APP + OBD to work with insurers to develop UBI and at the same time provide customers with car maintenance and other services.

4. Big Data + Insurers: In UBI field, some insurers, on the one hand, have self-run platforms, such as Zhong An Online P&C Insurance’s O2O car insurance, and on the other hand, co-develop platforms with Internet businesses or other connected car firms. For instance, CPIC organized Internet companies with Baidu and invested in Atzuche. Big data companies employ various methods in UBI field, like Beijing Jingyou Times Information Technology, a provider of database and risk models.

Key Topics Covered:

1 Overview of UBI

1.1 Definition

1.2 Pricing

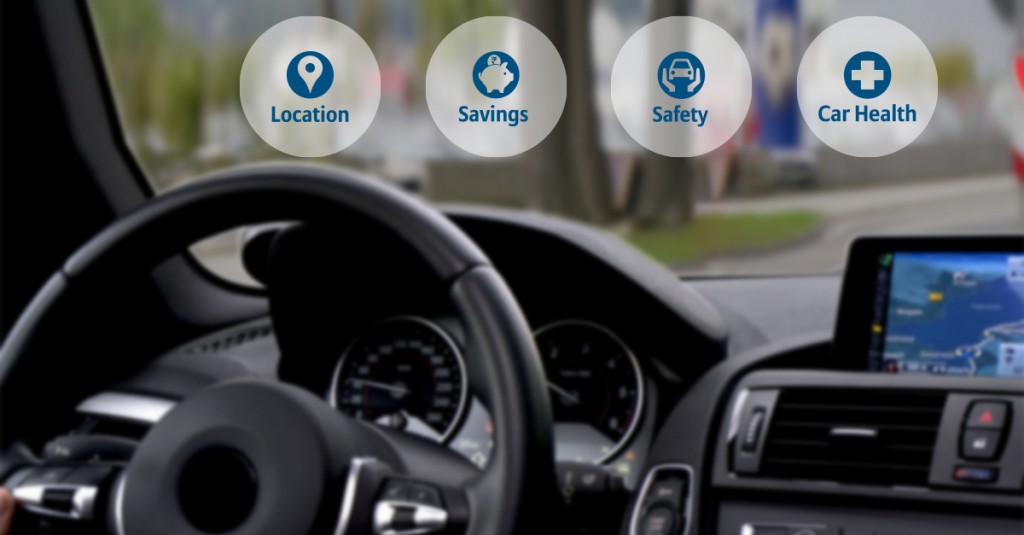

1.3 Value

1.4 Means of Acquisition

2 Global Telematics Insurance Market

2.1 Global

2.2 U.S. UBI Market

2.3 Canadian UBI Market

2.4 UK UBI Market

2.5 German UBI Market

3 Car Insurance and UBI Localization in China

3.1 Status Quo of Car Insurance in China

3.2 UBI Participants in China

3.2.1 OEMs + Insurance Companies

3.2.2 Telematics Platforms or Parts Suppliers + Insurance Companies

3.2.3 Independent Service Providers + Insurance Companies

3.2.4 Big Data Companies

3.2.5 Insurers

3.3 UBI Trends

3.3.1 Chinese UBI Market Size of RMB200 Billion in 2021

3.3.2 Market-based Reform of Car Insurance Rates Will Bring Unprecedented Opportunities to the Development of UBI

3.3.3 Diversified UBI Preferentials

3.3.4 Diversified Means of UBI Acquisition

3.3.5 Diversified Modes of Services Provided by Insurers

4 UBI Cases in Europe

4.1 UnipolSai

4.2 Generali

4.3 Allianz

4.4 Insure The Box

4.5 RISK Technology

5 UBI Cases and Companies in North America

5.1 Progressive

5.2 State Farm

5.3 Allstate

5.4 Desjardins

5.5 Hartford

6 UBI-related Companies in China

6.1 China Life Property & Casualty Insurance Co., Ltd.

6.2 PICC P&C

6.3 Ping An Property & Casualty Insurance Co. of China

6.4 Zhong An Online P&C Insurance Co., Ltd.

6.5 Carsmart

6.6 Cihon

6.7 DiNA Technology

6.8 PingJia Technology

6.9 Shenzhen Dingran Information Technology

6.10 Shenzhen Autonet

6.11 Launch Tech

6.12 MSD

6.13 Nanjing Renrenbao Network Technology Co., Ltd.

6.14 Deren Electronic

6.15 Zebra-Drive