The digital transformation of the insurance industry is in full swing. Insurance companies, as well as banks and other financial service providers, are more and more becoming IT driven companies. Digitalization offers opportunities to increase efficiency, offer new services, build better customer relations and combat fraud. It also presents companies with new challenges and investment requirements.

The Digital Transformation in Insurance Survey 2018 has identified and listed a number of global trends in this area. Developments are occurring at a fast pace. However, what is the current state of the industry? We will briefly highlight a few striking points of the survey.

Is online distribution more difficult than envisaged?

It seems logical and even necessary for insurers to switch to online distribution channels. Many establish online channels alongside traditional agents or advisers. Some only use online channels. Nevertheless, this development does not seem to be occurring as quickly as anticipated. 69% of insurers have some form of online distribution. In the 2016 survey, that was 65%. This is an increase of only 4 percent point. This is remarkably little because two years ago 25% of insurers who had not yet set up online distribution, indicated that they would do so within 12 months. You would expect 24 months later that the online presence of insurers would be around 75%. Perhaps setting up an online channel is more difficult than expected and digital transformation is therefore not occurring quickly. The pressure to digitalize seems to be perceived as higher, since 45% of insurers who do not yet have an online channel currently say they want to realize this in the coming year.

Innovative business models are not the logical next step for everyone as yet

An important characteristic of the modern consumer is that he/she is looking for speed, service and flexibility. You can see this development everywhere. A retailer such as Amazon is a good example of a company catering to this. The same development is also taking place in the financial services sector and it is technology that is making it possible. 35% of insurers currently offer the option of coverage based on use (for example car insurance) and 34% are working on some form of on-demand cover, for example with regard to travel insurance. 64% of insurers are starting this development themselves. Others are working together with a specialized technology partner. But apparently these developments are not yet the logical next step in the digital transformation for all companies. 25% of the insurers indicate they will not be taking any steps in this direction in the coming year.

Insurtech as the engine of innovation

88% of the insurers are convinced that insurtech offers great opportunities. While it is certainly possible to develop specific technology yourself, many companies like to use the expertise of specialized insurtech companies to support the digital transformation, for example for the development of mobile applications, machine learning, artificial intelligence, bots or blockchain, etc. The number of areas to be developed is extensive. The speed and complexity is mind boggling. Half of the insurers are now working on insurtech applications or conducting experiments with these applications. 19% are already investing in it. For insurtech, the question is whether to ‘make’ or ‘buy’. You can make it yourself, but can you also maintain it and innovate further? Cooperation in this area offers opportunities. 11% of insurers even consider buying insurtechcompanies to ensure continuity of maintenance and innovation.

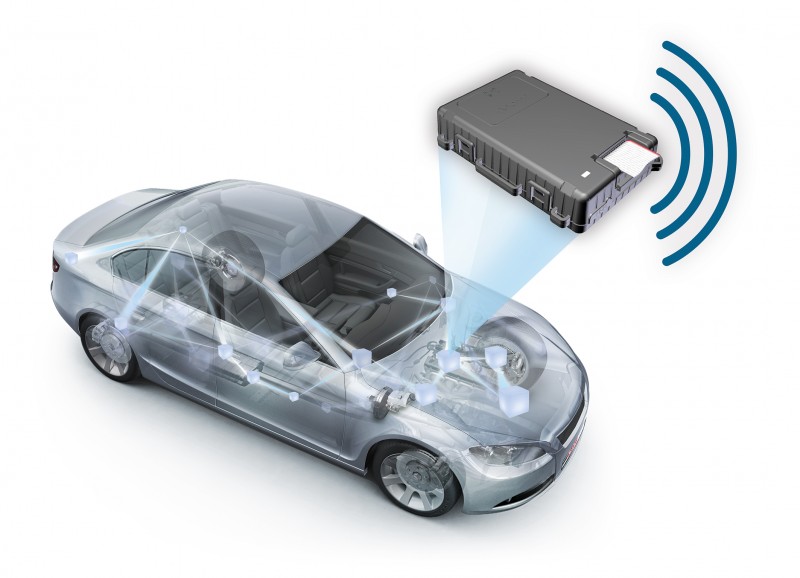

Fighting fraud is easier with technology

As processes speed up in order to provide better and faster service to customers, it is logical to expect that the number of fraudsters or fraudulent claims that are not discovered by claims handling will also increase. But technology also helps in this area, often without disturbing the customer experience. The basis of this is data and the possibility of using enormous quantities of data very quickly and with reliable results, for example for making predictive models. It is possible to make the automated claims handling process fast and friendly for honest customers. At the same time, it is possible to simplify processes, reduce risks and prevent and detect more fraud. 32% of insurers now use technology for fraud prevention. 48% of insurers use it to determine the level of premiums and 45% use it to support underwriting.

Visual screening during the claims process

Visual screening can be very valuable for claims handling and fraud prevention, such as the automated assessment of photos and videos of objects and damage. This makes the assessment objective and speeds up the process. It is possible to identify striking features or to make comparisons with similar objects via various sources. This can bring fraud to light. 29% of insurers now use such a technique. In the past two years, this percentage has not increased, but knowledge of the technique has. Insurers are also increasingly convinced of its value and 20% intend to start using the technique in the coming year.

Blockchain might be useful, but is currently in an early development stage

Insurers have also heard of blockchain, but it is scarcely developed. 44% have no idea as yet whether or how blockchain could be useful. Those insurers who have considered it, think it might be useful to simplify transactions, facilitate the claim process or reduce fraud. 21% are thinking of trying it. Only 2% have actually started.

Digital transformation as a motor

The digital transformation of the insurance industry is in full swing. The sector is very aware that this process is not something that is merely nice to have, but that it is increasingly the engine of the industry. However, not all developments seem to penetrate the entire sector as a matter of course and the pace is slower than expected, when looking at previous surveys. Companies leading the way therefore take a bigger lead and slower companies will have to make a big effort to avoid insurmountable technological backwardness.

Read more at https://www.friss.com/press/digital-transformation-in-insurance-what-is-the-current-state-of-the-industry/