Most insurance CEOs have a clear idea of what they want to accomplish through digitization. In their ideal world, customers can choose when, where, and how to interact with their insurers. New products are churned out daily. Quotes are issued and simple claims settled immediately. The organization resembles a collection of digital startups, all following an agile approach.

Despite having such clear goals, however, most CEOs have a lot of uncertainty about how to get to the target state. Nearly all European and North American insurers have launched digital initiatives—for example using new technologies to address current pain points, setting up customer portals, digitizing individual services, or enhancing analytics capabilities. They are using such “lighthouse projects” to achieve acceptance for digitization within the organization, initiate the needed cultural change, gather momentum, and attract digital talent. Yet the endpoint still seems unreachable.

WHY INSURERS STRUGGLE TO SCALE DIGITAL TRANSFORMATION

European and North American incumbents face a few unique challenges in undertaking digital initiatives:

- Channel Legacies. Strong, established agent channels may view digitization as a threat instead of an opportunity. If not properly managed, this can create a disadvantage for incumbents compared with new market entrants, and limit digitization efforts such as the introduction of new sales channels.

- IT Legacies. These include inflexible IT systems and infrastructure, with nonstandardized interfaces and duplication of core and peripheral systems, creating complexity and slowing down the digital transformation.

- Product Legacies. Product complexity hinders digitization of processes and implementation of new IT systems. (This is actually the greatest yet least recognized obstacle to scaling digital initiatives in insurance.)

These legacies only add to the difficulty of knowing both what the elements of a complete digital transformation are and how to sequence them. Insurers’ challenges in this regard are often compounded by three common errors:

- Lack of Coordination from a Business and Customer Perspective. Companies may fail to coordinate their various digital initiatives across business segments, or they delegate them to the CIO—or both. In addition, they often neglect to design new customer journeys from a customer perspective.

- Exclusive Focus on the Front End. Insurers have difficulty complementing the implementation of apps and portals with corresponding adjustments to the underlying operating model—including channels, steering, and service infrastructure.

- Low Usage of Digital Services. Digital channels have low traffic due to the complexity of authentication processes and the limited attractiveness of the digital offering itself.

A STRUCTURED FRAMEWORK FOR TRANSFORMATION CAN HELP

In light of all these pitfalls and perplexities, how can insurers move beyond lighthouse projects and set themselves on the path to complete digital transformation? We propose a three-stage process. (See the exhibit below.)

1. Starting the Digital Transformation

Many insurers have already begun piloting new customer journeys, which is an ideal place to start on the overall digital transformation process. Customer journey pilots must be the first step because they have immediate customer impact. Insurers should begin with the most important customer journeys based on the number of transactions, expected efficiency gains, and qualitative criteria such as impact and organizational buy-in.

2. Enabling the Digital Transformation

In this phase of the digital transformation process, insurers create the foundation on which the complete transformation will rest. The customer journey provides the underlying focus of the enabling effort, which involves creating new customer journeys in rapid succession. This phase has two components—transforming the operating model and industrializing the digitization process—that should be undertaken even as the implementation of new digital customer journeys is taking place:

- Transforming the Operating Model. The paramount need here is to develop a new channel strategy. Insurers need to adjust their capacity per channel as the number and types of transactions change. Simple transactions get digitized, while more time, empathy for customers in difficult situations, and expertise must be invested in complex transactions. For all the purposes described above, it is essential to adjust the skills profiles of employees and agents maintaining channels in order to ensure they can fulfill the requirements of a customer-centric insurer.

For European and North American incumbents with channel legacies, the new channel strategy must address agents’ concerns by keeping them in the loop on digital interactions, provide leads and cross-selling opportunities, and, when agents generate new business, have clear rules for commissions, depending on the channel from which the new business comes.

Finally, companies that offer customers free channel choice need to make processes and user experiences consistent—and data transparent—across channels.

Another aspect of transforming the operating model is steering, which must address a lack of business coordination by determining end-to-end delivery responsibility for customer journeys rather than following the logic of internal processes, and by aligning incentive systems with the resulting responsibility structure. Tracking the success of the new organization from the customer perspective is also essential. This can be done by measuring the customer satisfaction score—operationalized by KPIs such as processing time and immediate resolution ratios—to obtain actionable insights.

The last essential component of a transformed operating model is the implementation of a service infrastructure adapted to the requirements of the newly designed customer journeys. Key components of the required infrastructure are text and voice recognition (to turn nondigital and unstructured data into a digital format), input management, business process engines, an omnichannel service desk, and straight-through processing.

- Implementing a Digital Factory. Insurers can address slow development cycles by facilitating the “industrialization” of digitization initiatives with a digital factory. The digital factory is the primary vehicle for enablement, resource provision, and implementation support for digital initiatives. It follows a minimum-viable-product logic in which digital products are managed like small enterprises, with product managers who know the whole enterprise and cross-functional teams that follow an agile, iterative approach to collaboration.

The digital factory can play a key role in implementing a channel strategy that addresses the risk of low usage of digital services. It does this by developing a traffic concept for steering incoming transactions into digital channels. The traffic concept must ensure that: 1) traffic is routed to digital channels either within specific customer interactions or through overarching measures such as search engine optimization or advertising in printed materials and on the homepage; 2) digital customer journeys have tangible advantages for customers compared with nondigital ones; and 3) there will be enough customer journeys to create network effects as more people join in.

Traditional insurance products are complemented by digital value-added services that are typically provided by external partners. Identification, selection, and coordination of the partners who provide these services requires an institutionalized and professionalized partner management capability. The broader digital factory team must constantly scan the market for new trends and solutions, as well as partnerships with outside entities—including startups that are potential acquisition targets. Such partnerships must then be used to develop new solutions more quickly and efficiently than a company can on its own.

No discussion of the digital factory approach to digital transformation would be complete without considering the role of data analytics, which generates value from existing and new company data and supports data-based decisions—in risk management and underwriting, for example. A data analytics center of excellence acts as a knowledge aggregator and consulting service provider. It is also a governance body for making decisions about project prioritization and resource allocation.

The data analytics team identifies and selects strategically relevant use cases to be implemented jointly with the organization. The center of excellence must have the ability to enhance current digitization efforts through more sophisticated use of data—such as by finding new patterns that will enable a different way of designing products, individualizing those products, and tailoring the go-to-market approach according to segments.

3. Scaling the Digital Transformation

In the scaling phase, the digital factory team hands over the customer journeys it has developed for integration into the agile sales and service organization. This handover is not a one-time process, since there will always be new customer expectations and demands, new technologies, and new competition requiring customer journeys to be continually adapted and improved. At this point on the transformation path, insurers need to deal with five key issues that cannot be productively tackled at the beginning of the journey but must be addressed now if the digital transformation is to reach a critical mass and become sustainable:

- Product Simplification. In the early stages of digital transformation, tactical solutions are the most suitable options. One such solution is to simplify products through feature consolidation as well as the elimination or standardization of individual arrangements with brokers and large customers. Only later in the transformation journey should insurers fully replace their old product portfolios and implement purely digital products.

- IT Replatforming. Although consolidating the IT landscape right from the start would be ideal, this takes a long time and cannot be allowed to hold up changes at the front end. For this reason, interim architectures that use modern technologies such as robotic process automation need to be put in place, and replacement of legacy systems taken off the critical path.

- Agile at Scale. While agile ways of solution development, involving constant iteration and testing, are very useful for initial implementation of end-to-end digital journeys, they become imperative once the latter have been introduced on a large scale. This is because digital customer journeys must be continuously adjusted and enhanced as customer expectations and competitors’ offerings evolve. Insurers can achieve such continuous improvement by changing the operating model to create an agile change-and-run organization—with a change entity responsible for continuous improvement of customer journeys and a run entity to operate them based on the agreed service targets. This operating model, in fact, is the only way of sustaining agile ways of working within the larger organization.

- AI at Scale. It is deceptively easy to launch AI pilots with initially powerful results. As the number of high-value pilots increases, however, insurers run into certain challenges. AI learns inductively from data, which causes new forms of entanglement and new complexity for vendor and partner management. Other challenges include a scarcity of AI talent and skills, cultural resistance, issues of governance and organizational structure, and the need for end-to-end AI application. This is when AI at scale becomes the name of the game. It consists of the ideation, prioritization, implementation, and deployment of AI use cases; broader transformation of the operating model (including the industrialization of the data infrastructure and the creation of an AI ecosystem); and new people, skills, and processes.

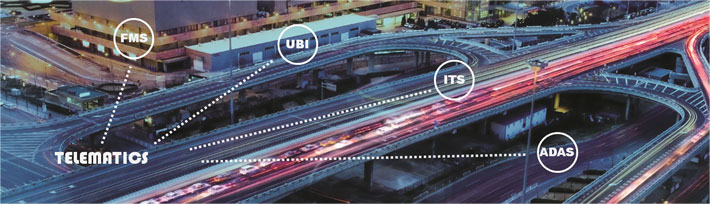

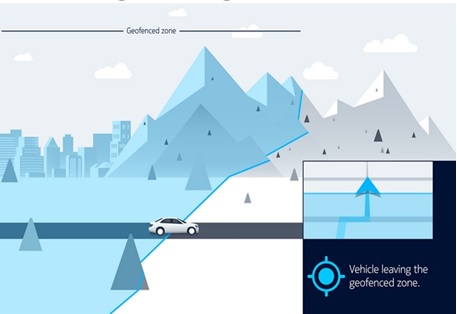

- Ecosystems. We see three sets of new offerings, each with its attendant ecosystem, emerging in insurance: 1) a “segment of one”— personalized, targeted offerings based on deep customer insight, processed through high-engagement channels, and enabling early detection of needs and rich, real-time profiling; 2) one-stop-shop services that offer a variety of targeted products (for example, services for people over age 70) on a single platform; 3) proactive, real-time, sensor-based management of risk objects (such as home sensors to prevent or mitigate fires). The emerging ecosystems threaten the most important competitive advantages insurers enjoy along the value chain, potentially marginalizing incumbents. Insurers must therefore understand the economic opportunity and threat, prioritize offerings based on the company’s strength, and build the right operating model for fostering rapid innovation.

PLAN FOR THE LONG GAME

The initiation of a digital transformation and development of the necessary organizational capabilities and formats typically take at least three years, often five, and sometimes more. As an example of a five-year transformation, consider the case of a German insurer currently transforming its business model from a mainly agent-based structure to one that is digitally enabled.

The five-year digital transformation was initiated with two customer journey pilots, complemented by short-term improvements such as more proactive communication of processing times. The customer journey implementation is supported and enhanced by a fundamental transformation of the insurer’s service delivery model and establishment of a digital factory for digital governance, use of consistent methodologies, and provision of agile resources. Although the organization has already adopted agile ways of working, the full-scale transition to a customer-centric delivery model with a change-and-run organization is scheduled for the second and third years of the transformation.

Digital transformation is a journey that will substantially change the way insurance organizations deal with customers and agents and run their operations. While the framework outlined in this article covers the key components and their sequence, it should not be translated into an inflexible master plan for the entire transformation, which would be contrary to the agile approach. Instead, this framework provides a blueprint for roadmaps originating in a clear vision of the target state but continuously enhanced and adapted based on organizational learnings and changing customer requirements.

Read more at https://www.bcg.com/industries/insurance/digital-transformation-insurance.aspx