Over the past 18 months, U.S. auto insurers have expressed renewed interest in usage-based insurance as consumers become more comfortable with the concept. Some U.S. insurers are seeing growing uptake for their telematics insurance programs. Over 30% of new customers are now opting for usage-based insurance at Nationwide and Progressive, for instance. The maturation of smartphones as telematics sensors is also playing a considerable role in shaping insurers’ renewed interest.

For an insurer, deploying a simple app on customers’ smartphones presents many advantages over having to ship an OBD-II dongle. Insurers can save on hardware and shipping expenses, avoid the risk that the dongle might mess up the car computer, reduce installation hassle for consumers, and lower the risk that the policyholder will ultimately decide not to install the costly device.

Still, despite the many benefits of deploying a smartphone app, insurers’ approach suffers from a fundamental flaw from an underwriting perspective: Insurers must enroll their policyholders in the program before they get enough data to properly price the customer.

Enroll first and price later is not an optimal approach for insurers or consumers. The insurer is limited to using telematics data for the fraction of consumers who are willing to sign up for the program, such as teenagers who may not have better alternatives. And consumers generally don’t know what the ultimate premium will be, as it is to be determined based on an initial evaluation period.

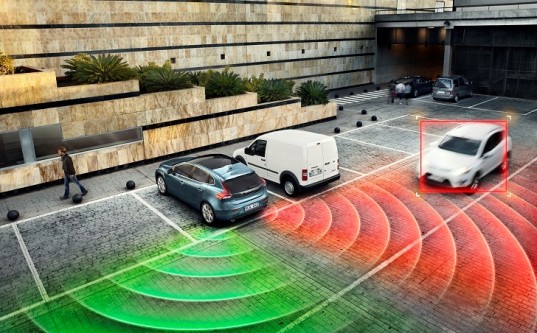

To become mainstream, usage-based insurance will need some additional breakthroughs beyond expanding the list of sensor options. We believe that the next breakthrough in usage-based auto insurance will come from the development of data exchanges allowing insurers to access consumers’ driving behaviors—with their permission—to make them a firm offer upfront.

There is a growing list of firms that are now willing to share such “ambient data”—provided consumers give their consent—with insurance companies for the purpose of enabling consumers to get deals from insurers, including comparator websites, car manufacturers, telcos, app providers, and more.

In the next few years, we expect that more and more consumers will be offered special deals from insurers based on their anonymized driving behaviors. To secure those deals, consumers will simply have to reveal themselves to the insurer. Consumers will be able to benefit from telematics insurance while remaining in control of their data and retaining the ability to deny access to their personal identity information. Out of privacy and security considerations and other concerns, most likely, insurers will not have access to the full driving history and details but will simply gain access to a sanitized score and some other high level of driving analytics elements.

In the long run, of course, as the use of telematics data becomes more and more prevalent, it’s likely that consumers who opt to not share their data will end up paying more, as insurers tend to view those customers as riskier. Some consumers may resent that evolution at first. But the fact is, it’s already how things work when a consumer applies for insurance and authorizes an insurer to pull a credit report. The difference is that driving data is a far more sensible, fair, and surgical way to truly judge someone’s risk than the blunt proxy of a credit score.

Read more at http://aitegroup.com/blogs/gwenn-b%C3%A9zard/next-breakthrough-usage-based-auto-insurance-underwriting-ambient-data