When the term “telematics” is mentioned—at least in the US insurance marketplace—most people think of usage-based insurance (UBI). But telematics isn’t just for usage-based insurance rating anymore. Carriers are looking to telematics in claims adjusting, loss control, fleet management, and more as they seek to gain competitive advantage.

“I do expect to see more carriers using telematics in automotive book management and servicing,” says Monique C Hesseling, partner in insurance consulting, Strategy Meets Action. “We’ll also see more carriers piloting additional services based on telematics, such as roadside support and trip support based on where you are and what your needs are, and other concierge-type services.”

Follow the Leaders

In UBI, Progressive has staked a market leadership claim in the personal lines space, and the company doesn’t appear to be relinquishing that spot any time soon. More than 2 million vehicles have participated in Progressive’s Snapshot program since its launch in 2004, and those vehicles have produced a lot of data—more than 10 billion miles of it to date and counting.

“We are just wrapping up an investment in a ‘big data’ system using Hadoop, based within Progressive’s data center,” says David Pratt, general manager of usage-based insurance at Progressive. “We moved all our Snapshot data into that system, which allows us to do our analysis much more quickly than before.”

Progressive’s program, originally introduced as “Tripsense,” continues to require a proprietary device plugged into the insured vehicle’s OBD port. Nearly one-third of Progressive customers at least give the program a try. After a 6-month installation of the device in the vehicle, customers are presented with a range from no discount to a 30% savings based on their driving habits and can decide whether or not to continue with the program.

Although it started its UBI program 6 years after Progressive, Allstate has racked up 3 billion miles of data in its Drivewise program, which also uses an OBD device. The program is currently available in 39 states and, according to company spokesperson Justin Herndon, about one-third of new customers sign up for the discount program where it’s offered.

Analytics are the key to use telematics data for UBI. Companies hold their analytic formulas close to the vest, and Progressive and Allstate are no exception. Pratt says his company’s proprietary approach is a culmination of years of incremental analysis.

“It’s a process of developing hypotheses and testing them,” he says. “If you are driving and see somebody acting like a jerk, how do you find ways to measure that behavior? We have the big data set to test those hypotheses.”

Progressive is collecting new types of data for analysis, equipping some of its Snapshot devices this year with GPS capabilities for research into how vehicle location data might be used. “Our theory is that if we know a vehicle’s location, we will be able to build better predictive models. The example I like to use is that we think a mile driven on the highway is safer than a mile in the city, but without a distinct location recorded, we really can’t tell between the two. I hope by next year we can improve the product by adding location data to it,” Pratt says.

Allstate’s latest development in Drivewise is using its mobile app, installed on drivers’ smartphones, to collect driving data, rather than relying on an installed onboard device. The smartphone option is available in three states, and Allstate plans to expanding to another six by September 2014.

“A little more than half of all our customers declare themselves as smartphone users. The [Drivewise] app is a way for us to offer them UBI through a device they already own and provide them with other value-added services,” Herndon says.

Digesting the Data

To some extent, UBI growth in the US—or lack of it—has been impacted by Progressive’s seven patents around UBI. Although Liberty Mutual won a case this year challenging several of those patents, Progressive appealed the decision and claims its patents are valid and enforceable until the appeal process is complete. Progressive initially sued Allstate for patent infringement, although the two companies reached an agreement that allowed Allstate to continue its program. Progressive now offers licenses for its patents.

“We’ve negotiated patent licenses with nine U.S. companies, including Allstate and USAA. We have licenses with six of the top 25 U.S. auto insurers,” Pratt says.

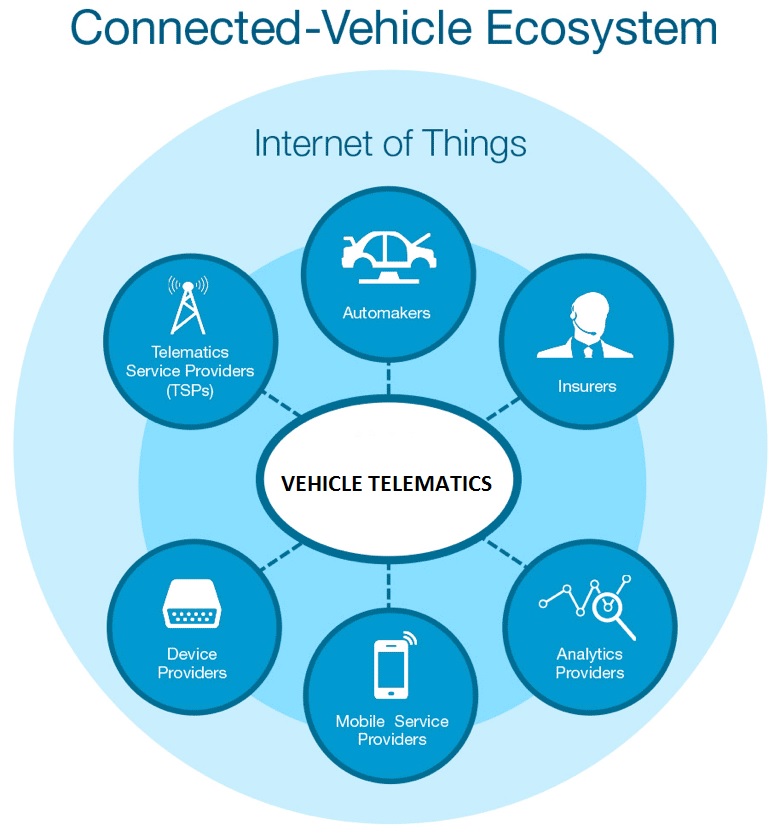

The other challenge for companies looking to get up-to-speed in telematics is how to develop their own predictive models, which require a large amount of data over time to generate confidence. Third parties, such as Deloitte Consulting and Agnik Analytics, have stepped up to offer UBI scoring models for insurers.

Insurers can also pursue telematics as a complete service. Octo offers an end-to-end solution based exclusively on a service model. Insurers can pay either a fixed contract cost or a monthly fee, which covers a OBD device, telecommunications, and data.

One of the most recent companies to enter the telematics-as-a-service space is VOXX Electronics Corp. In June 2014, the electronics manufacturer launched its Car Connection Insurance Discount Program, which is in partnership with several insurers including American Family, Liberty Mutual and The General Automobile Insurance Services.

Rather than attempt to lure customers to use a telematics device based on insurance discounts, VOXX targets its program to customers who first purchase the company’s onboard device and subscribe to Car Connection in order obtain vehicle monitoring services.

“We believed that if we could put the right hardware and backend features and services together, it would be compelling for consumers to purchase the device on their own without an insurance component. Our research showed that consumers wanted a feature-rich solution that includes knowing where their vehicle was, how teen drivers were doing, vehicle health and so on,” says Thomas C. Malone, president of VOXX Electronics Corporation.

“For insurers, we take the ‘connection’ out of the equation by connecting them to a piece of hardware that consumers purchase on their own. Insurers don’t have worry about the hardware and distribution,” Malone adds.

The Car Connection Insurance Discount Program uses Agnik’s analytics and delivers a score to insurers. But whether telematics as a service will take off remains to be seen.

“It depends on the philosophy of the insurance company and how comfortable actuarial and leadership is with a ‘black box’ approach to data. If they are okay with working with a data environment that is not 100% their own, they will be okay with the service-based model. However, some carriers will want to have full ownership of their data and how they analyze and use it,” Hesseling says.

“There may one day be standardization of telematics data, but we are a long way from that,” says Nino Tarantino, CEO of Octo Telematics North America, explaining that including a OBD device is a key component to Octo’s service offering. “Insurance companies today still need something they can own and control and customize it for their purposes. Every company has its ‘secret sauce.’”

Beyond UBI

A common non-rating use for telematics already in play is fleet management for commercial lines insureds.

“Telematics in the U.S. was actually first and foremost applied in commercial lines to manage fleets. It helped with driving behaviors, rest times, planning routes, determining the most efficient utilization of vehicles, and so on,” says Hesseling, pointing to fleet-safety programs from insurers such as Zurich, Liberty Mutual and The Hartford.

ProSight Specialty Insurance is one of the most recent entries in fleet telematics in commercial lines. Designed for long-haul trucking, charter and school busses and taxi fleets, ProSight’s SecureFleet offering combines an integrated vehicle data and video event recording system with a driver coaching program.

The SecureFleet program captures information such as G-forces on the vehicle and real-time information from the engine control module and other vehicle safety systems. That data is analyzed to uncover risky driving behavior. ProSight covers the cost of the device, with the policyholder responsible for installation costs and a $50 annual connection fee per vehicle.

ProSight expects to recover its program expenses through improved loss ratios and believes policyholders will cover their costs as well. “For our customers, we estimate that the ROI is high, driven through reduction in loss frequency, lower costs associated with vehicle maintenance, and increased claims visibility when there is a accident,” says Jeremy Zottneck, transportation executive at ProSight.

When a risky event is identified, the system is designed to capture 10 seconds before and after the incident. The SecureFleet team wirelessly reviews each event and scores and prioritizes it for coaching. In addition, safety and fuel economy are tracked at the driver level and benchmarked across fleets to help transportation companies understand where gains can be made.

With the program recently introduced, it’s too soon to tell what the ultimate penetration will be, but Zottneck is optimistic. “We include the program in the [auto insurance] quote for any company that qualifies, and we are pushing it as aggressively as possible, he says. “We see this being a game-changer in the transportation insurance space.”

Personal lines insurers are also looking to leverage telematics in claims. “All our partners are considering using our telematics device to get benefits for their claims management,” Tarantino says. “Rather than asking users to return the device after they have used it to score the policyholder, they are keeping it in the car to capture more data at the moment of the crash.”

Octo is in a test program with one insurer that involves aggregating device-level data with third-party data, allowing claims adjusters to better assess what happened at the time of an accident.

“The device is able to capture risk events—acceleration, braking, cornering, fast lane changes. We are enriching that with contextual data—the weather, traffic information at that particular moment, and so on, to see if conditions matched with those reported by the driver, or if driver behavior lessened or worsened the risk of external conditions,” Tarantino says.

The Future of Telematics

“We are moving toward a more mainstream adoption of at least having a minimal telematics offering for customers,” says SMA’s Hesseling.

“Our insurance partners are going very fast with telematics. We have seven programs in the U.S. and three in Canada,” Tarantino reports. “In 2014, we have more than doubled our average monthly shipment of devices compared to 2013. Our partners are rolling out more programs in more states, and are training more agents.”

“We are exploring new technology to make it even easier for customers to share driving data with us. One way of doing that would be collaborating with vehicle manufacturers to share OEM-device data with us. Another would be using mobile phones to detect driver behavior so that we wouldn’t have to ask customers to plug devices into the car,” says Progressive’s Pratt.

“I’m confident that usage-based insurance will continue to grow,” he adds. “It’s such an easy action—plug in a device, pay less for insurance. That will become more and more appealing for the customer.”

Read more at http://www.propertycasualty360.com/2014/08/12/telematics-carriers-expanding-tools-beyond-usage-b?page_all=1