Usage-based motor insurance (UBI) is generating a huge amount of interest at the moment. But are insurers’ IT infrastructure ready for it?

In the space of around 15 years, 6 to 7 million American drivers have agreed to have their driving behaviors monitored using telematics in return for a potentially cheaper auto insurance policy.

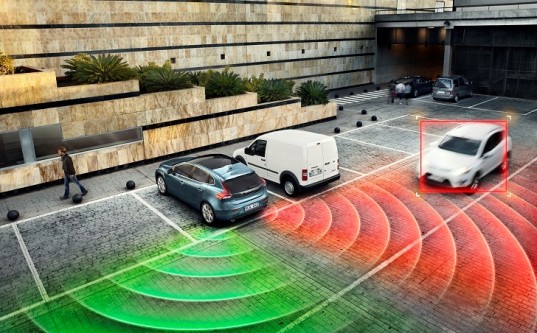

Market growth to date has mainly relied on UBI pioneers persuading consumers to have in-car devices fitted in their cars to gather details such as speed, braking and location.

Now, smartphones, connected cars and other data sources from the Internet of Things promise to unleash the potential of UBI as a true mass-market product, particularly because the emerging technologies will reduce insurers’ costs and should enable policyholders to determine at the quote stage if a telematics policy will benefit them before they buy one.

Burning question for insurers

A burning question, however, is how property and casualty (P&C) insurers’ IT systems will keep pace at a time when they are already under greater stress than ever before from big data, pricing and policy administration demands.

The good news for insurers’ IT departments is that technology supplied by the customer (bring-your-own-device) should effectively eliminate the need to manage technology fulfillment.

The harder part will be handling, analyzing and sharing exponentially larger volumes of data. The complexity of creating appropriately flexible systems will rise as will the potential of the analysis paralysis that gripped many early UBI programs.

There will be no one-size-fits-all approach or fixed timescale. The key will be to balance what the company wants to achieve with its IT and resource capabilities—and then find the right partners to fill in any holes.

Stay flexible

Partners that have the capability to adapt with technology will be very important. For example, the explosion in the volume and origins of data that could be useful to a UBI program means that organizations with experience managing and analyzing diverse, non-uniform and multisource data—everything from summarized trip level events to accelerometer readings—should increasingly come into their own.

And with all these additional data to manage, partners that provide the skills and technology to turn the data into useful knowledge for the parts of the organization that need them, often confronted by a complex web of legacy systems, will be particularly valuable.

Effective telematics programs will need a strong, resilient and forward-looking IT and analytics base—that much is certain. A danger will be trying to over-engineer the solution. Companies will need to build in flexibility, identify suitable, like-minded partners, and act fast to avoid forever playing catch-up at this potential tipping point for UBI.

Read more at http://blog.willis.com/2017/04/insurers-is-your-it-ready-for-usage-based-insurance/