Professor Peter Handel, Professor of Signal Processing and Head of the Department of Signal Processing, Royal Institute of Technology KTH

Some two decades after the initial ideas and trials of insurance telematics, the technology and business around it is beginning to mature and reach the mainstream. Currently, around 15 million insurance customers subscribe on an insurance telematics program worldwide.The article outlines the opportunities and challenges of insurance telematics, with an emphasis on the driver behavior information that telematics provide, and technology required.

The digitalization of the vehicle insurance industry goes along two directions important for competitiveness.

The first direction is to gain bottom-line-growth by improving the efficiency of digital storage, data transfer, and information processing. By Moore’s law,a continuous improvement of the digital capabilities is provided in terms of faster processing, higher data rates, and more efficient data storage. IT-departmentsand their CIO play an integral part in the refinement, modernization, and improvement of the legacy systems for the insurance industry.

The second direction of insurance digitalization enables both bottom- and top-line-growth and relies on the novel digital capabilities that the ubiquitous sensorisation enables. The sensorized and connected vehicle is able to sense and transmit its movement, on-the-road-behavior, and the traffic and environmental surroundings around it. In vehicle telematics, this sensing capability is provided by vehicle-mounted black-boxes, OBD-dongles or smartphones, or combinations thereof. The choice of sensorisation is determined by factors like hardware and installation costs, data accuracy and reliability, data transfer costs, and privacy and fraud aspects.

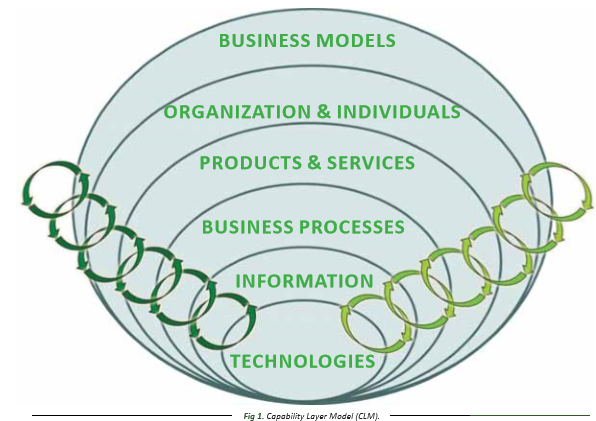

There are valuable business opportunities related to insurance telematics, because of increased customer satisfaction by the digital channel that can reduce the cost of customer acquisition and retention, reduced churn and more efficient handling of claims; and improved risk prediction by the value-added telematics information. The top management of the insurance companies has achallenge to find the best business model, organization, individuals, and business processes to form novel telematics-based products and services. For commercial success, all layers in the capability layer model (Figure 1) have to be considered and mastered.One should not underestimate the efforts it takes, and have in mind that it is a challenging task to design, implement, and run these new insurance services and products. This is a fact that is evident from the many shut downs and non-successful insurance telematics trials over the last decade due to reasons such as lack of personal integrity and data security, cannibalization on the current business model, and technology obstacles. These obstacles should be and will be overturned in a properly designed insurance telematics service.

Telematics-based products and services open up for two game changers compared with the traditional vehicle insurance product. First, telematics provides the means for continuous dialogue with the customer via a digital customer channel. The insurer can provide benefits to its customer in terms of real-time information like traffic information and driving behavior, but also maintenance information that supports a sustainable ownership of the vehicle over its lifespan. Second, the insurer can affect the actual riskof accidents and injuries by providing proper feedback to the driver in terms of driving tips and warnings.

Telematics-based products and services open up for two game changers compared with the traditional vehicle insurance product. First, telematics provides the means for continuous dialogue with the customer via a digital customer channel. The insurer can provide benefits to its customer in terms of real-time information like traffic information and driving behavior, but also maintenance information that supports a sustainable ownership of the vehicle over its lifespan. Second, the insurer can affect the actual riskof accidents and injuries by providing proper feedback to the driver in terms of driving tips and warnings.

Telematics is “hardware technology and sensor information” so it is relevant to spend some extra efforts analyzing the inner layers of the capability layer model in Fig 1. From an information and technology perspective, there are fundamental questions to be answered when designing an insurance telematics program.

First, what kind of information sensed by the vehicle instrumentation correlates with the actual risk of an accident or an injury? There exists no magic formula, which translates the vast amount of sensor readings to actual measures of risk of an accident or injury. The insurance telematics pioneer US-based Progressive Insurance has presented their finding linking driving behavior to risk based on their vast experience. Based on research evidence, experience and pragmatism, measure like time-of-day, location, speed and driving behavior can be formed to risk related measures.

The second question relates to the customer added-value proposition. What kind of telematics information should be presented to the driver during the trip, and afterwards? Real-time driver-feedback via the smartphone is illustrated in Fig 2 – here mimicking the vehicle’s dashboard. For example, a feedback showing excess speeding in combinations with incentives to reduce it, typically leads to a reduced average speed and thereby a lower risk. Recent results from the CMTDriveWell program indicate that incentive programs can provide a reduction ofrisk factors like phone usage and number of harsh braking, even beyond a 6 months period. An experience from the Movelo campaign in Sweden is the importance of insurance customer categorization to enable more focused incentive programs. Some kind of risk-relevant information like actual position is, on the other hand, something that the driver merely cannot influence for a given trip, and should be left outside the incentive model.

The answers to the above two questions provide the technical specification on the telematics hardware. Hard-wired vehicle-installed black boxes are costly but suitable for commercial operations with stringent requirements, whereas the smartphone provides a fully scalable low-cost alternative with an outstanding price performance metric. Today, the smartphone is a viable in-vehicle node for commercial insurance telematics thanks to the advances in hardware and software technologies [1]. OBD-dongles are a compromise between the black box and the smartphone solution with a natural role in the telematics echo system.

We can summarize that telematics based insurance products and services are here to stay. Although it is a marginal part today of the total insurance business, the trend is clear. Telematics and related technology will change the insurance industry. The advances in technology requirethat the insurer broaden their skills and competences in telematics technologies. Already today, the chase for knowledge and skills has manifesteditself by the recent industrial mergers and acquisitions, like Generali’s acquisition of MyDrive, or Direct Line’s acquisition of The Floow.

Insurance telematics enables innovative products and services, and thereby open up for both bottom-line and top-line growths. The telematics data enable a granular risk differentiation based on the true risk level of the drivers. It provides incentives for a sustainable transportation system with reduced carbon dioxide footprint, less material damage, and reduced human suffering.

Source: http://telematicswire.net/opportunities-and-challenges-of-insurance-telematics/