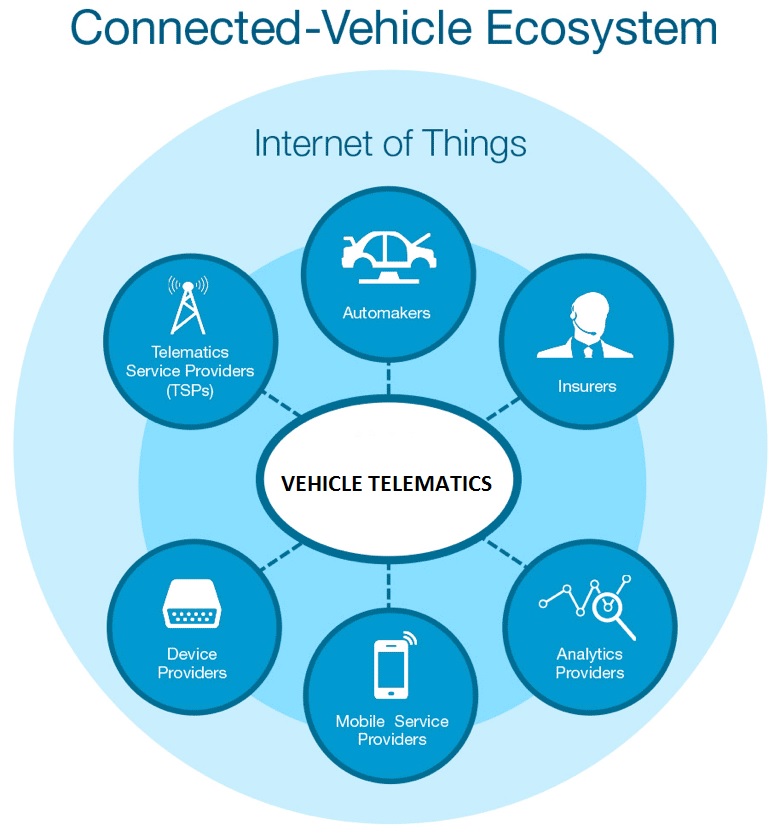

An expanding array of telematics devices and services, combined with focused government mandates, will help the technology break into the mainstream.

After decades as a niche feature, telematics is merging into the automotive mainstream (see sidebar, “Defining telematics and usage-based insurance”). Research on car-data-monetization trends and characteristics suggests that this value pool could be as large as $750 billion by 2030. While current adoption rates remain low across markets, they could grow significantly through the first part of the next decade, according to the GSM Association, an organization comprised of mobile-network operators. There are two reasons for this. First is the increased willingness of governments to mandate specific telematics services, such as emergency-call capabilities, which is already happening in the European Union and Russia. Second is the increasing appetite from consumers for greater connectivity and intelligence in their vehicles.

Car telematics has the potential to increase road safety, improve driving behavior, align insurance premiums with actual need via usage-based insurance (UBI), and boost car-insurance-industry profitability. It also seems clear that telematics can bring additional benefits to individuals, corporations, and governments beyond insurance and road-safety improvements. Examples include driving-style improvements to boost fuel economy, location-based services such as stolen-vehicle recovery, real-time tracking, vehicle-finder services, vehicle-maintenance alerts, and fuel and routing optimization.

Today’s adoption levels remain below 20 percent

In the current market-driven, voluntary-use telematics landscape, no country has attained adoption rates that exceed 20 percent (Exhibit 1).

The technology’s benefits become evident even at these niche levels. For example, most users cite antitheft, lower insurance premiums, and improved driving behavior as key benefits of telematics today. Its use in the United States reached about 20 percent in 2016, Italy saw 17 percent, and Singapore 9 percent. That same year, global UBI adoption made possible by telematics expanded to 14 million policies.1

While virtually all markets currently feature voluntary car-telematics systems, regulators in many countries want to mandate the technology in specific circumstances. For instance, the European Union seeks e-assistance systems in case of accidents. The eCall system, mandatory for all new EU vehicles as of March 2018, should speed up emergency-response times by 40 percent in cities and 50 percent in rural areas—in the process reducing the number of fatalities by at least 4 percent. Russia mandated a similar system for new cars by the end of 2017, while Mexico has sought mandatory radio-frequency-identification (RFID) tags to bolster vehicle-antitheft systems. Many other countries, including China, Germany, Singapore, and South Africa, have voluntary systems that provide UBI incentives.

The overall advantages of car telematics are proportional to the technology’s adoption rates in given markets (Exhibit 2). In many cases, it takes significant scale to unlock specific benefits. For instance, road-safety-related advantages begin at low telematics-adoption rates (20 percent or less) and tend to increase more rapidly as rates grow. However, other advantages, such as traffic optimization, require much greater adoption levels (roughly 40 percent or more), while smart-city infrastructure benefits need an even greater telematics presence (almost 80 percent).

Connecting the connected car

Today, car owners have multiple options for outfitting their vehicles for telematics services. These range from do-it-yourself add-on devices to professionally installed systems. Multiple players have begun to offer customers telematics devices and solutions. For instance, some insurance companies bundle telematics devices with their motor-insurance policies, car manufacturers may offer built-in telematics devices and customized services to differentiate their offerings from other manufacturers, and certain fleet operators leverage telematics devices to optimize and manage a network of cars.

What follows are descriptions of key types of telematics devices. The final two typically require professional installation.

Smartphone app. Perhaps the easiest and most straightforward connected-car option is an app that turns your phone into both a telematics sensor and transmitter. Typically capable of autonomously detecting trips, these apps offer trip scoring based on driving behavior, habits, and the driving context, although the quality of the data collected may not be the best. Apps usually issue proactive notifications such as traffic alerts, weather alerts, and service workshop locations. They are also used in tandem with hardware solutions to enhance service offerings such as warnings, driving tips, reporting, and gamification. They tend to be modular, fully configurable, and work on open platforms to facilitate additional app development.

Read more at: https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/telematics-poised-for-strong-global-growth