As technology related to artificial intelligence, natural language processing, smart home tech and more evolve, business applications are emerging that can have a transformative effect.

From an insurance industry perspective, some of the most exciting developments are those that are changing the way insurers interact with their customers.

Many insurers have struggled to apply technology and data effectively to build solid relationships with customers. Traditionally, insurers don’t frequently engage with their customers, due to their unique role in their lives. Insurers provide a critical safety net, but customers usually don’t think about it until they need it, unlike for example their near-daily relationship with their bank.

But insurers who embrace their unique role in their customers’ lives are finding new ways to reach out to them on their own terms and applying technology and data to deliver an exceptional customer experience at every stage of the customer journey.

Insights about customers

Property and casualty insurers who want to compete and win in a highly personalized, data-driven business climate now have the tools they need to do so. Data provides a more complete picture of customers than ever before. The flow of information from traditional and new sources — including telematics, the IoT and smart home tech — continuously generates insights to help insurers understand their customers better and gauge risks more accurately.

In 2017 and beyond, forward-thinking insurers will look for new ways to personalize outreach, fine-tune services and deliver the right information to the right customers at the right time to win the micro-moment. And through it all, technology will act as their superpower, providing the data and platforms insurers need to become their customers’ heroes.

Keep an eye on the following three technology trends, which have the potential to shape industry outreach and service delivery over the next year:

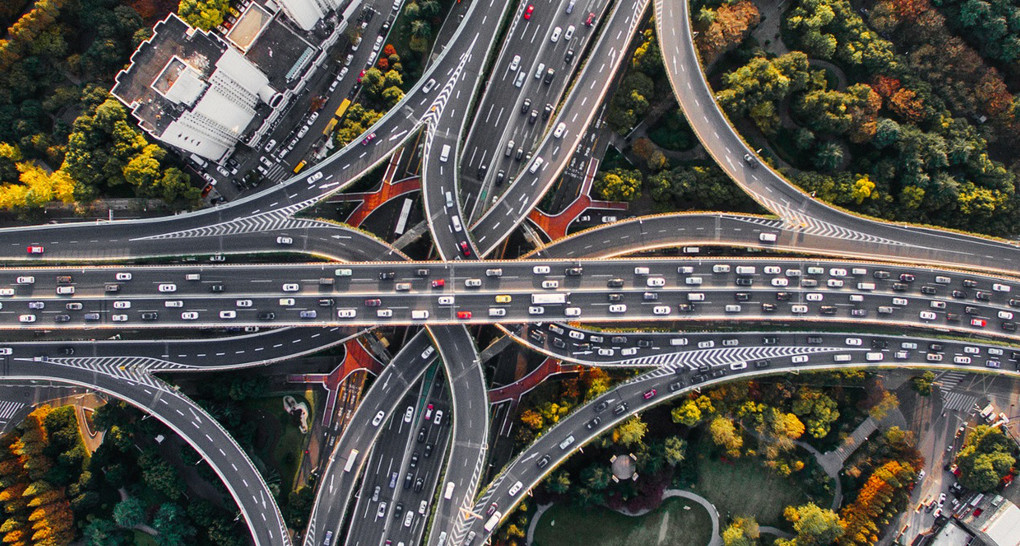

Insurers have traditionally lagged behind peers in other industries on using data-driven, personalized outreach. (Photo: Bigstock)

1. Data-driven personalization gets a boost

Consumers routinely receive personalized offers and recommendations from retailers and entertainment platforms, and companies across industries are embracing personalization for a simple reason: it works.

A 2016 report from respected independent research firm Forrester called “The Untapped Benefits of Proactive Customer Communication” cites a 40 percent increase in customer satisfaction from personalized, proactive communication as well as a spike in the Net Promoter Score (NPS) of companies that use personalized outreach.

Insurers have traditionally lagged behind peers in other industries on using data-driven, personalized outreach. In part, that’s because so many insurance companies struggle with customer database accuracy. In the past, insurers’ contact with customers was limited to claim transactions and renewals, so insurance executives at many companies aren’t confident that their data is accurate and up to date, which is a prerequisite for personalized outreach.

An in-house or third-party data cleanup project can restore executive confidence and prepare the way for data-driven personalization. Any such effort should include securing customer preferences for contact across multiple channels (e.g., email, SMS, social media, voice, etc.) and gaining permission to engage customers on an ongoing basis. As the Forrester report indicates, there is a huge upside for insurers — and enormous benefits for customers.

(Photo: Shutterstock)

2. Insurers continue to find new roles for data

While personalization is a notable trend in data application, insurers are finding other roles for data that go far beyond simple outreach. Telematics is transforming the industry as auto insurers increasingly use it to get an accurate snapshot of how their customers actually drive, measuring miles driven, acceleration, airbag deployment, hard braking and cornering, etc. This gives underwriting teams hard data to make sure premiums align with risks.

Property and casualty insurers are also looking at new ways to use data generated by smart home tech and the Internet of Things (IoT) to prevent losses. Connected sensors can transmit data to insurers in real time, triggering a communication platform to contact customers or their preferred vendors about a situation such as a water leak or temperature change, allowing them to nip potential problems in the bud and prevent a major loss.

(Photo: Shutterstock)

3. The micro-moment becomes the battleground for brands

Google defines the micro-moment as the “intent-driven moments of decision-making and preference-shaping that occur throughout the entire consumer journey.” Micro-moments are also becoming the new battleground for brands, as companies seek to position their services in the top spot when customers search for information and make decisions about purchases.

Insurers are reacting by placing personalized information on mobile-friendly platforms, which is a good first step since so many searches originate from mobile now. But owning the micro-moment requires an omnichannel strategy. For example, the ability to respond to a quote request via an automated voice or text message or deliver a notice to a mobile phone when a claim is processed can be important assets in the battle to win the micro-moment.

Read more at http://www.propertycasualty360.com/2017/04/05/3-insurance-technology-trends-for-building-custome?page_all=1