Vehicle insurance is a cornerstone of the automotive industry, but it’s transforming

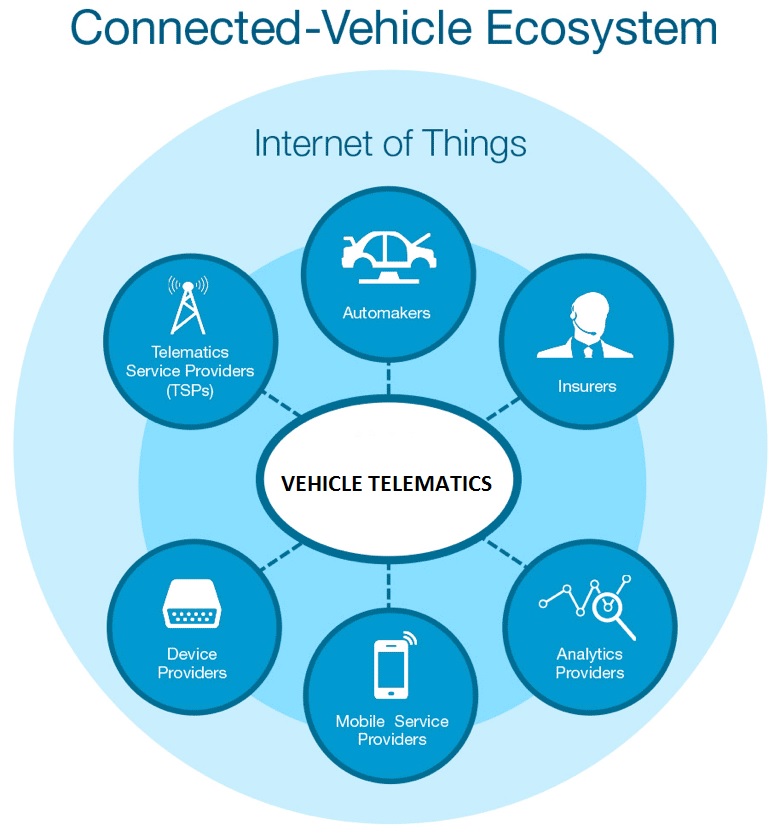

Fortunately for drivers, there are plenty of insurers to choose from, and they are all competing to provide low rates while still generating a profit. One of the biggest waves of the IoT era on the industry in recent years has been the advent of telematic devices and other sensors that encourage safe driving and offer a discount to drivers who meet certain criteria.

A growing number of insurance companies allow customers to place optional devices in their car to gather various driving metrics. While these black box devices are proprietary, nearly all of them contain at least one common component: accelerometers, which measure how often drivers accelerate or brake abruptly. Although emergency scenarios can require a driver to slam on the brakes, cautious drivers, who are less likely to be involved in an accident, are far less likely to brake harshly on a regular basis.

GPS devices can also provide valuable information about a driver’s habits to insurance companies, potentially resulting in lower premiums. Those who drive less frequently are less likely to be involved in a crash, and insurers can use this information to adjust premiums accordingly. Furthermore, some areas are more prone to crashes and other incidents, and GPS devices can offer valuable feedback about where drivers spend their time. GPS monitoring can also detect when drivers haven’t filled out their insurance information accurately; drivers might claim, for example, to live in an area that’s less expensive to insure. GPS feedback encourages drivers to be truthful on their applications.

Easy Recovery

Insurers have an incentive to locate stolen vehicles. Block boxes equipped with GPS monitors can lead law enforcement officials to a vehicle’s location, letting drivers recover their cars and insurers avoid having to cover the cost of replacement. This information can be helpful to law enforcement officials as well, as knowing where thieves typically take stolen cars can help prevent theft in the future.

Insurers have a vested interest in encouraging drivers to operate their vehicles in a safe manner. Some in-car devices provide feedback; a loud beeping noise when a driver accelerates too fast or brakes too abruptly can encourage better driving habits and reduce the likelihood of accidents. This feedback provides a service to other drivers on the road as well, potentially making the road safer even for those who don’t opt for telematic devices.

Technology is revolutionizing vehicles, and it might not be long before most people opt for self-driving cars. However, technology is also having a dramatic affect on the economics of vehicles. Insurance plays a valuable role in encouraging safe driving behavior, and allowing drivers to save money by using sensors to demonstrate their safe driving habits can lead to fewer incidents.