Given technology innovation, it’s imperative that we look ahead, constantly scanning the road for fraud hazards in order to safely avoid hitting them head on. Two of the immediate hazards lying on the insurance roadway that everyone should have on their radar screens involve the “Internet of Things” (IoT) and telematics.

Oxford Dictionary defines IoT as “a proposed development of the Internet in which many everyday objects are embedded with microchips giving them network connectivity allowing them to send and receive [real time] data” to an individual, organization or business.

Telematics is on the rise

According to Gartner, telematics refers to “wireless and black box” objects (devices). Current telematics applications in the insurance industry involve automobiles, where Gartner states that “installed or after-factory boxes collect and transmit data” for policy-rating purposes.

There are limited telematics devices in play right now, but much like the Internet usage explosion, which was commercialized in the mid-’90s, many believe that we’ll see a similar rise in telematics device deployment over the next 20-30 years.

Cisco, however, thinks the surge in telematics devices might happen even quicker, predicting that “up to 50 billion things (or devices) will be connected to the Internet by 2020; or, the equivalent of six devices for every person on the planet.”

While telematics is primarily thought of in terms of the Property and Casualty industry (automobiles), with a device boom, it’s inevitable that usage will eventually expand into other lines of insurance, including Life and Health.

We may however, already be there.

![]()

(Photo: Thinkstock)

Current devices

Much like insurance companies using telematics to gage individual driving habits for rating purposes, there are fitness companies manufacturing personal devices, known as “wearables,” so individuals can assess health-related information (physical activity levels, food consumption/calories intake, weight loss and sleep habits).

While wearable devices are primarily designed for individual usage, visualize those same devices transmitting information back to an insurance company to assess rate information for Homeowners, Commercial, Life, Disability, Workers’ Compensation or Health insurance policies.

Some probably think that’s extremely futuristic, but actually it’s not that far-fetched. According to insurer John Hancock, the company recently began offering policyholders in their “Vitality” program a free Fitbit to track their fitness efforts and health progress.

The Vitality program’s goal is for insureds to stay healthy, and doing so, accumulate points similar to a rewards program. The more points an insured earns, the greater the rewards available to them, including premium savings.

Consider the future of device technology. A recent insurance industry survey by Accenture reported that approximately “63% of respondents believe that wearable technologies … will be adopted broadly by the insurance industry within the next two years while 31% of respondents indicated that they are already using wearables to engage customers, employees or partners.”

Use of telematics isn’t a faraway concept. It’s being used right here, right now.

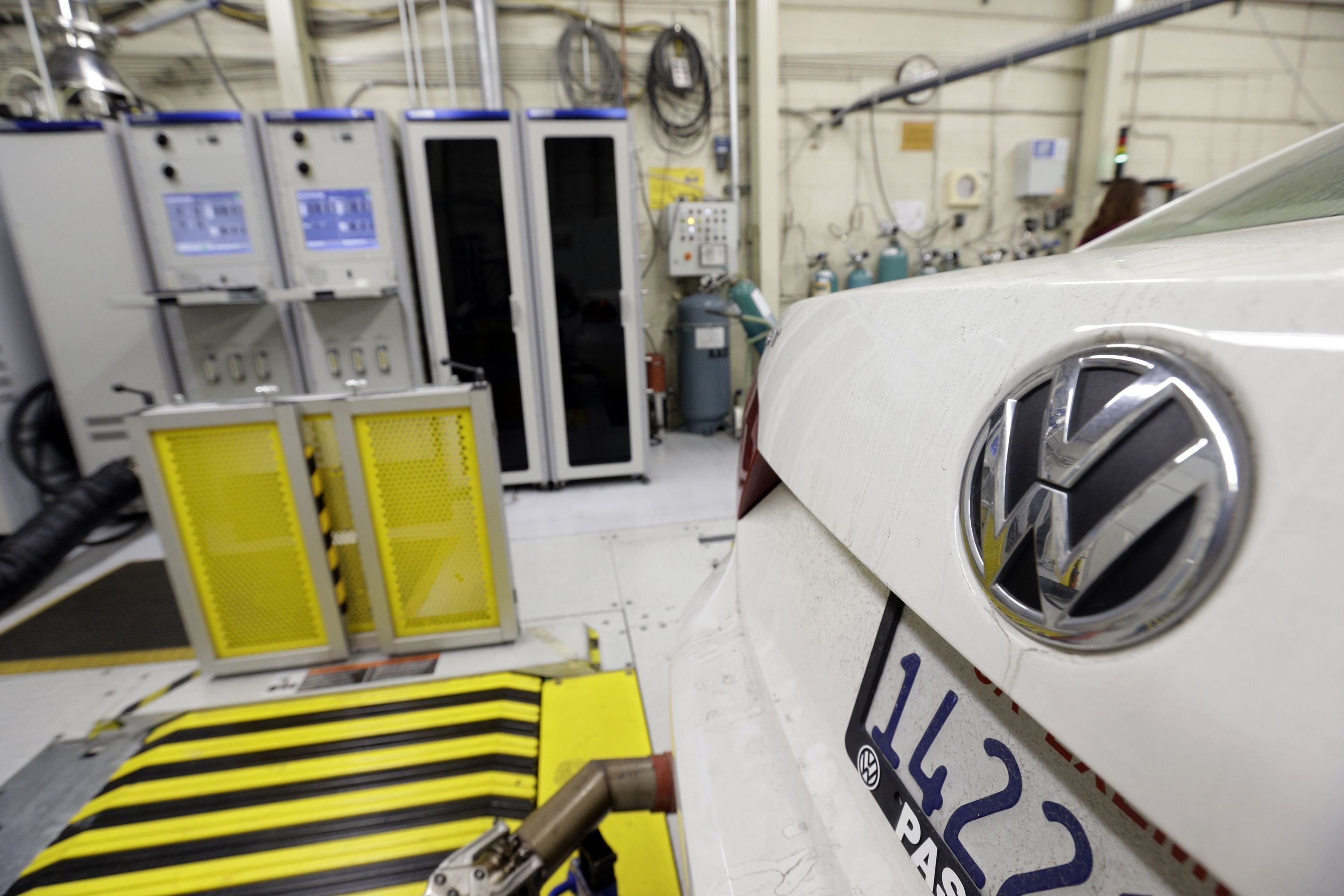

In this Sept. 30, 2015, photo, a 2013 Volkswagen Passat with a diesel engine is evaluated at the California Air Resources Board emissions test lab in El Monte, Calif. Three years after Volkswagen opened a pollution testing center in Oxnard, Calif., VW admitted that it manipulated emissions results in 482,000 U.S. diesel vehicles to make them appear to run cleaner, raising questions around Volkswagen’s only test center in North America. (Nick Ut/AP Photo)

Device manipulation

In the auto industry’s current telematics environment, installed devices not only report information back on individual driving habits but also car performance, maintenance issues, crash data, vehicle location data and airbag deployment.

As we’ve seen in the news lately, automobile information can also be reported back for regulatory and emissions purposes. There’s not a better example of how devices can be manipulated, to fool federal regulators and unsuspecting consumers, than the massive allegations in the current case going on in the automobile industry involving Volkswagen.

VW has admitted to installing software on vehicles to skew emissions tests. The device manipulation has sparked the opening of a criminal investigation by the Department of Justice, and according to USA Today, the Enviromental Protection Agency “could fine Volkswagen up to $37,500 per car, which would equal a maximum fine of $18 billion.”

Obviously, at that level, EPA fines alone would dwarf the $7.3 billion that VW has reportedly set aside to cover fines and penalties, not to mention any monetary fines and penalties the DOJ could impose.

While software is legitimately used on vehicles for a variety of reasons, the ability of a business or individual to manipulate devices for competitive or financial advantage, is significant. This type of device fraud will certainly migrate to the insurance industry.

(Photo: Thinkstock)

The elements of fraud

Having talked about devices on the new fraud frontier, consider the essential elements of fraud: “A deception, which is deliberately practiced, and relied upon, by the victim, to their disadvantage.”

These elements are the foundation of “old school” fraud definitions and weren’t written with “new age,” telematics or IoT technology in mind. Interestingly, however, they’re still extremely applicable to the hazards lying on the business road ahead.

When devices are manipulated and transmit false data back to an insurance company that’s deception — and there will be a disadvantage to the company just like any other type of fraud. Given where the insurance industry appears to be going with devices and technology, fraud is a topic everyone should be talking about — yet strangely, few are.

(Image: Thinkstock)

Manipulation motivation

Since negative information transmitted from devices to insurance companies has a direct correlation to policy cost, there’s significant motivation to manipulate devices and the data generated from them.

If the insurance company doesn’t realize that data transmitted from a device is false, then they errantly rate the policy according to the perceived risk. Naturally, since the risk information transmitted would be less than the actual risk, fraud occurs.

Historically, claims and policy data have been manipulated. Although this started with paper claims and policy applications, device data manipulation is really no different than an applicant’s failure to disclose material information to an insurance company during the application or claim process.

Case in point: Consider a life policy where an applicant is motivated to conceal a dangerous hobby, or activity, as increased risk greatly increases the policy’s premiums and may decrease the coverage the applicant is able to purchase.

Another possibility is a workers’ compensation or disability policy where transmitted data would be significantly inconsistent with a claimant’s stated Activities of Daily Living — representations or restrictions which prevent returning to work — all motivation for device deception.

(Photo: Thinkstock)

Organized crime rings are more progressive than we are

To combat the new type of fraud that’s on the telematics and IoT horizon, insurance companies must be progressive in their anti-fraud approach. However, this may prove challenging given the sophistication of the groups committing fraud these days.

A number of years ago, I wrote a piece stating that organized criminal organizations are far more progressive, dynamic and fluid than most businesses. To be successful in their mission to commit fraud day after day and be profitable, organized rings have to be innovative.

Further, organized crime rings don’t have the corporate constraints associated with organizational politics, budget constraints, personnel (silos and turf wars) or bureaucracy.

Given all the fraud prevention efforts being deployed across verticals, the only way organized crime rings continue to make money is for them to stay one step ahead of the technology or prevention efforts.

Every coin has two sides. For every product or service developed for a legitimate business purpose, there is someone already thinking about how to profit from the illegitimate side of the coin.

The fact is that new IoT and telematics technology is more than likely already sparking fraud innovation from criminals. More often than not the fraudulent efforts begin the day the product or service rolls out.

(Illustration: Thinkstock)

Fraud on day one

Fraud doesn’t wait for technology products like telematics and IoT to mature; it usually starts in a product’s infancy. Consider this scenario: Years ago, I was working for a company in the telecommunications industry. The company spent five years developing a new service to roll out to customers.

Five years of research and development (R&D), and the very first day the service hit the market the company was hit with massive fraud. The service got clobbered and everyone wondered why. Unlike some companies, it wasn’t because the business failed to think of the various fraud applications, plan for them or build adequate fraud defenses.

The reality was that the bad actors also spent five years in R&D figuring out how to commit fraud against the service. They anticipated what the company’s defenses were likely to be, and where the vulnerabilities in strategy were, creating a successful attack vector. This approach ensured that the ring could be organizationally profitable when the product initially went to market.

Seeing the amount of fraud, the business quickly went back to the drawing board and fixed the service’s loopholes that were allowing fraud to occur, but the financial damage was already done.

The telematics industry will surely face similar fraud challenges going forward. Make no mistake; bad actors are already thinking about how to beat the system or the device in this case.

(Photo: Thinkstock)

Analytics plays a role in investigation

If there’s an upside to this story, it’s that the IoT and telematics gold rush happens to coincide with a significant boom in the fraud analytics space. Insurance companies are currently using analytics systems to identify fraud patterns, the presence of organized criminal activity and claims that adjusters/investigators should be focusing on. Further, device analytics and technological countermeasures will become even more imperative.

The ability to determine whether devices have been hacked, altered or tampered with to generate false claims or policy data will be critical to preventing massive device fraud and the payout of fraudulent claims supported by intentional deception and material misrepresentation.

The massive number of new devices connected to the Internet also means an influx of big data generated for insurance companies and presents significant business challenges.

The challenges are generally three-fold:

- Creating effective data management programs (along with costs, head count, legal issues and training).

- Figuring out how to analyze voluminous amounts of data.

- Developing data integration back into claims, policies, underwriting, actuarial and marketing initiatives.

We’re in the middle of a device gold rush

The rapid growth of IoT and telematics is the newest technology deployment and everyone in the insurance industry, no matter what your role, should be aware that it’s on the near horizon. Considering Cisco’s IoT and telematics prediction of 50 billion devices connected to the Internet in the next five to 10 years, we’re in the middle of a device gold rush.

When a connected device stands between an insured, a policy or a payout, there will be significant motivation to manipulate both the device and the data generated from it in the insured’s favor.

This not only mirrors current fraud schemes, which arose after the commercialization of the Internet, but also materially misrepresented policy data provided to insurance companies in other (paper or electronic) forms.

Still think there won’t be a significant device fraud as a result of IoT and telematics implementation? If 50 billion devices are connected to the Internet, it’s not a matter of “if” it will happen but “when,” and insurance companies should be preparing for the fraud onslaught now.

Read more at http://www.propertycasualty360.com/2015/11/02/the-internet-of-things-a-telematics-gold-rush?page_all=1