The idea of usage-based insurance, or using data on driver behavior to price auto insurance, has been around almost as long as the industry itself. The difference between then and now, however, is the advent of GPS and telematics technologies, which allow insurers to collect real-time driver data.

Telematics 101

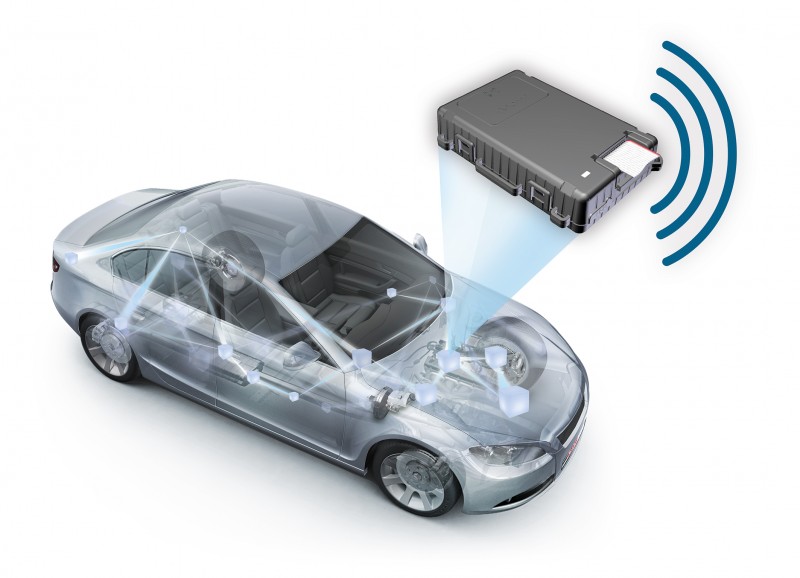

The concept of telematics is pretty straightforward. A data collection device is plugged into the OBD-II port of the policyholder’s car. The device then collects data on acceleration, location, miles traveled and braking speeds to create a picture of how the policyholder is driving. The data is then uploaded for the insurance company to review. Insurance companies can analyze how policyholders are driving to price policies more competitively, according to the National Association of Insurance Commissioners (NAIC).

Telematics data provides valuable insights into driver behavior, and it allows insurers to mitigate the risks of various driving behaviors. According to the NAIC report, “It has been noted that 90 percent of drivers view themselves as better than average, suggesting they would be amenable to products which base their rates partially on ‘how’ they drive.”

While these programs are still opt-in and there are people who don’t want their data collected, the concept is gaining popularity. The NAIC notes there are currently active programs in 42 states. According to a Towers Watson survey, 8.5 percent of drivers have or had a usage-based policy in 2014, which is double the number from a year prior.

The future of telematics

It is significant that some 80 percent of policyholders cited in the Towers Watson survey were interested in value-added services such as theft tracking, emergency response services and vehicle wellness alerts. This can give insurers a great opportunity to upsell and cross-sell new products and services. Further, once high-risk drivers see their performance data, they may be more willing to change their behavior. Analytics tools allow insurers to provide policyholders with a list of specific discount factors, such as miles driven and hard-braking events, and keep customers updated on where their driving habits fall on the discount spectrum. Because they can track their own performance, policyholders will likely make an active effort to improve their driving.

Insurance companies can also gain an advantage from improved customer perception. After all, LifeProHealth notes that insurance is the least-trusted industry in the world. Traditionally, auto insurance was assessed based on where policyholders live and how old they are, not on if they were good drivers. It is no wonder customers are skeptical. By linking actual driving performance data to premiums, however, insurance companies can increase affordability for lower-risk drivers and give policyholders the ability to control their premium costs. By putting the control in the customer’s hands, insurance companies can improve the way society sees them.

A further competitive advantage from all this data is that insurers can reduce fraud through collected data on hard breaking and speed. Even vehicle recovery can be improved with telematics devices because they can be used to track a stolen vehicle.

While still in its infancy, telematics is expected to grow as the industry and its customers see the benefits of safer roads and lower premiums. According to the NAIC, 36 percent of all auto carriers will have some sort of usage-based insurance option in place by 2020. The insurers that lead this movement will likely gain a substantial advantage over their competitors.

Discover how telematics offers insurers significant competitive advantages , including greater insight into driver behaviors, for better targeted marketing and strategic initiatives.

Read more at http://www.ibmbigdatahub.com/blog/usage-based-insurance-telematics-give-insurers-competitive-edge