Usage-based pricing is not a theoretical future. We experience it on a daily basis every time we make a phone call or fill up our cars with fuel. The question is: How to find a competitive edge by replacing traditional flat-rate services with usage-based pricing in a market consisting of infinite and difficult to measure variables? Part of the answer lies in astute application of new concepts, such as the Internet of Things (IoT).

For several decades, pricing for services has been gradually moving away from the one-size-fits-all, cookie cutter approach entrenched in business by the industrial era. Mass production did indeed reduce costs, enabling people en masse to afford products and services that were formerly available only to the financial elite. Though mass produced, the products had limited variability.

Usage-based pricing brings an entire paradigm shift in the way goods and services are priced. It massively increases variability while reducing costs and increasing affordability still further.

Not business as usual

Much of traditional business will seem outrageous in a few years’ time. In fact, even now, we would think it ridiculous if everyone were charged the same on their cell phone bills, regardless of usage. We certainly wouldn’t countenance the ability to buy a subscription to the supermarket, regardless of how many of its products you consumed – or a subscription to your local petrol station, regardless of how much fuel you used.

It has to be preposterous, therefore, to pay the same general amount for your short term insurance, medical insurance and vehicle warranties, among others, given the advent of technologies such as the IoT, which enable companies to quantify usage and behaviours so as to charge on individual consumption and behavioural patterns.

Behaviour-led financial services

The insurance industry was one of the first to understand this. It recognised that providing cover merely on the basis of gender, age and residential area was too superficial and inflexible to enable realistic pricing or risk assessment over and above an acceptable aggregate that the underwriter felt was sufficient.

Although the conventional model worked for the most part, on average, it makes no sense from a risk profiling point of view to automatically penalise a cautious young driver while rewarding an older one who drives recklessly.

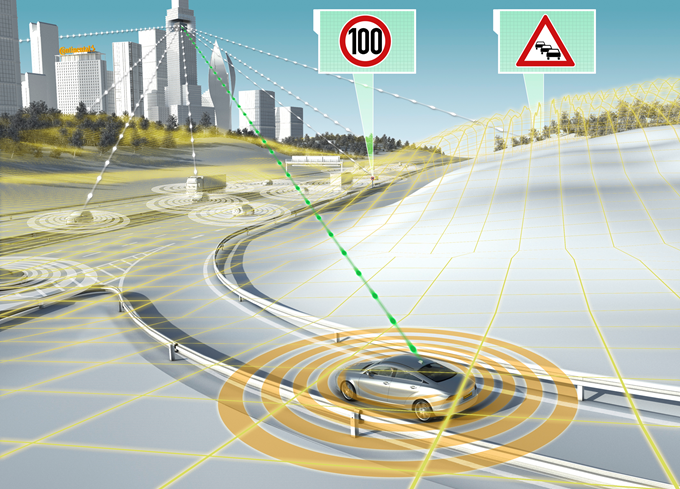

So, insurers are beginning to use telematics, for instance, to track the way a person drives and the areas in which they drive. Using techniques such as machine learning to analyse the information derived in the field, cross-referenced with millions of other drivers, allows for usage-based models that compare claims data with driving behaviours. This has spawned an entirely new industry known as usage-based insurance (UBI).

Some insurers allow a mobile application to be installed on the driver’s phone to monitor driving behaviour for a period of time in order to generate a customised quote. Should the client’s driving improve or degrade over time, so will the premiums.

Before UBI and IoT, there was no complete digital record, when a claim was made, of details such as how fast the car had been travelling at the time of an accident and what the force of impact was. It’s a bit like having a passenger airliner without a black box. Without such information, it was difficult to remotely assess the level of damage to the car and therefore the ultimate cost to the insurer of repairing or scrapping it. In fact, the cost had to be expanded to include the price of human assessors around the country.

Without telematics there was also no way to offer value added services such as dispatching an ambulance to the scene of the accident should the mobile device or telematics hardware accelerometer detect an impact beyond a certain dangerous threshold.

Now digital data reduces the cost of processing claims. By communicating all the new digitally available information to a policyholder, insurers can more easily justify premiums. Policyholders can see the impact of their own actions on their premium. Most importantly, perhaps, insurers can get policy-holders to adjust their behaviour by driving more mindfully.

Usage-based insurance, therefore, holds game-changing benefits for the insurer and the insured. It also spills over into benefits for society as a whole by encouraging drivers to voluntarily change their behaviour in order to be safer.

Behaviour-led healthcare

In healthcare, the most powerful arguments for monitoring patient behaviour are the potential for saving lives and reducing hospital readmissions.

According to a number of surveys done in the United States, patients being readmitted to hospital within 30 days of being discharged cost medical schemes up to $41.3 billion over an 11-month period.

Congestive heart failure accounted for 1.35 million readmissions at a cost of $1.7 billion. Unchecked diabetes led to $588 million in additional costs.

Repeat hospitalisations also place patients at greater risk for complications, hospital-acquired infections, and stress. Being mostly for non-surgical services, readmissions are not profitable for hospitals. Yet, a high percentage of readmissions can be prevented by improving patient discharge instructions, coordinating post-acute care, and reducing medical complications during the initial hospital stay.

Digital and mobile technologies are ideal prevention tools. Wearables that measure vital signs such as blood pressure and heart rate can track patient health outside of the hospital and, thereby, assess patient compliance with discharge instructions as well as the efficacy of medications. Treatment can be adjusted remotely and its effects seen in real time.

Advanced analytics and the sharing of information via cloud applications also enable medical practitioners to identify trends linked to patient demographics and behaviours. Using machine learning techniques, they can more accurately predict what kinds of medication would be beneficial to certain patients and not to others. And they can make recommendations to patients on the behaviours that will provide them with the best health outcome once discharged from hospital.

Instead of using a blanket approach, by applying similar medicines to similar conditions, the medical fraternity can use patient behaviour to more closely align medication, hospitalisation, and outpatient treatment with the desired health outcome. The patient is better equipped with information and tools that enable them to manage their own health. In the process, they help reduce the impact on society as a whole of behaviourally driven health issues. Medical insurance can be priced and paid for far more accurately – per person, based on their behaviour.

Some private health care providers are also using wearables to motivate customers to exercise as well as participate in routine health checks in order to increase the health of the insured base and reduce the future likelihood of claims. The use cases on which we are capable of delivering today via IoT, machine learning, pervasive connectivity, and cloud platforms are simply astounding. We are able to tackle problems head on by creating solutions that would have been computationally unfeasible a few short years ago.

Behaviour-led automotive

Usage-based operations are beginning to show beneficial effects in the automotive industry, too. Predictive maintenance is enabled by connected cars and sensors built into various parts of the car indicating where and when a person is driving, how heavy their fuel or tyre usage is, and how, by comparison with other drivers and other models, a particular vehicle is performing. It is possible to tell a driver when their brakes will need replacing or whether the clutch is about to break.

Instead of being structured around a standard year and mileage plan, vehicle warranties will be based on usage. Red-line your car too often or push too many G’s around the next corner and your vehicle manufacturer may reject your claim for engine damage or mounts that need replacing due to too much stress causes by excessive forces.

Usage information can also be fed into research and development, as part of the continuous improvement of vehicle manufacture. For fleet owners, the information is vital for controlling costs and improving productivity among their drivers. Usage-based warranties become possible, making fairness a differentiator for original equipment manufacturers and insurers.

The writing is on the wall

Whatever the industry, the barrier to entry for providing usage-based pricing is lower than ever due to recent technology trends. They provide the ability to track, capture, and analyse customer behaviour in real time. More to the point, they enable on-the-fly adjustment of pricing, products, and services as customers adapt their behaviour to provide themselves with the experience and lifestyle outcomes they want.

This is not the future. This is now. Customers are starting to expect this type of commercial model. And, because everyone will have the same operational capabilities, differentiating your business will come down to bringing new behaviour-focused products and services to market first. That will mean collaborating within an ecosystem of partners in which everyone’s innovation feeds everyone else’s market.

The behavioural bottom line is speed and agility.

So, don’t waste time reinventing a wheel that is already spinning very productively. Find a technology partner that can help you both align your business strategy with customer behaviour and provide you with the enabling tools.

Read more: http://accelerateintodigital.com/blog_post/putting-stamp-usage-based-pricing-economy/