84 percent of businesses in the public sector are investing in the Internet of Things (IoT) and Big Data, with the financial services being amongst the top ten early adopters.

But, what exactly is in it for the financial services?

IoT and Big Data can revolutionise the way the finance sector uses data and interact with their customers. By deploying sensors and analytics to gather useful client information, businesses can begin to provide personalised, convenient functions and improve customer satisfaction.

Jim Eckenrode, the executive director of Deliotte Center for Financial Services, states that:

The IoT may be as broadly transformational to the financial services industry as the Internet itself, and leaders should make an effort to recognize the opportunities and challenges it presents for the financial sector as well as for industries with which FSIs work closely.

So what are some of these key opportunities financial services firms can take advantage of? Here are five game-changing IoT and Big Data trends to look out for in finance.

5 Key IoT & Big Data Trends in the Financial Sector

1. Personalised Messaging

Many IoT technologies use sensors to collect, share and interpret Big Data. Financial organisations can harness these sensors to track customer behaviour and provide personalised messaging.

For instance, imagine being able to send a reward or personalised offer directly to a customer’s phone as they walk into your bank. Or, sending geo-located balance alerts based on their activity, whether they’re visiting their favourite pub, shop or café (no longer will they have to rely on their conscience to prevent overspending).

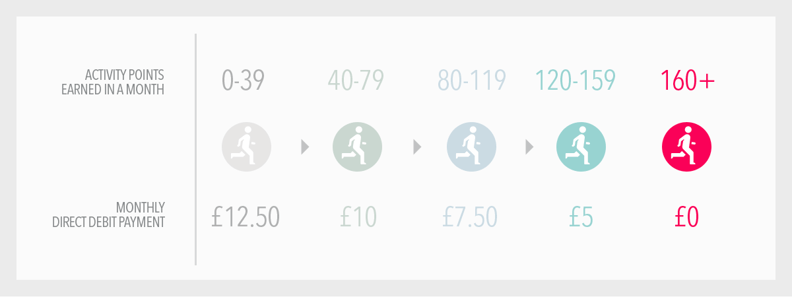

2. Usage-based Insurance

Some insurance methods are becoming outdated and, in order to keep customers satisfied, functions need to become more efficient and personalised. In today’s data-driven world, digitalising processes and implementing IoT can help to reform the way insurance is dealt with to better suit your customers.

That’s why many insurers are using IoT technologies to create ‘usage-based insurance’. For example, you could use IoT devices to influence car insurance policies by tracking customer telemetry and looking for patterns in behaviour and mileage. This big data telemetry can then be used to estimate the right car insurance bill and underwrite a better policy.

3. Inventory Tracking and Monitoring

Over 40 percent of small businesses do not track their inventory or use a manual process. Without accurate inventory management, tracking stock can become time-consuming and cost companies a lot of money.

Commercial banks are trying to remedy this issue with the help of the IoT. Using biometrics and sensor technology, banks can help to track anything: from a retailer’s stock, to the condition of a farmer’s crops and livestock. This, in turn, can help businesses manage their products more efficiently and help ease the manual burden of supply chain and trade finance.

4. Automatic Payments

Instead of allowing customers to pay for bills manually, imagine automating their payments through connected IoT technology?

With the help of new ‘smart home’ technology, financial organisations could offer devices that connect to household appliances and handle bill payments automatically. Integrating payment features into everyday appliances such as these will allow users to make shrewder purchasing decisions based on consumption not assumption.

5. Wealth Management and Investment

The Internet of Things and Big Data have the power to reform wealth management and investments in finance, too.

By collecting data on client behaviour, locations and purchasing patterns using IoT ecosystems, financial institutions could be able to send clients tailored investment offerings. This could prove to be a less intrusive and more ‘socially responsible’ method to investing and would help make automated portfolio management a reality.

Avoiding the Pitfalls of IoT and Big Data in Finance

With 30 percent of organisations already adopting IoT solutions and 56 percent implementing Big Data strategies, it’s fair to say that the technology is set to change finance across the board.

However, the concept is still fresh and financial institutions shouldn’t make the jump to IoT before careful consideration and proper planning. After all, without the right roadmap or IT support in place, your organisation won’t be getting the most out of the technology.

Read more at https://www.redpixie.com/blog/iot-big-data-finance